Grow your business with the name shoppers trust.

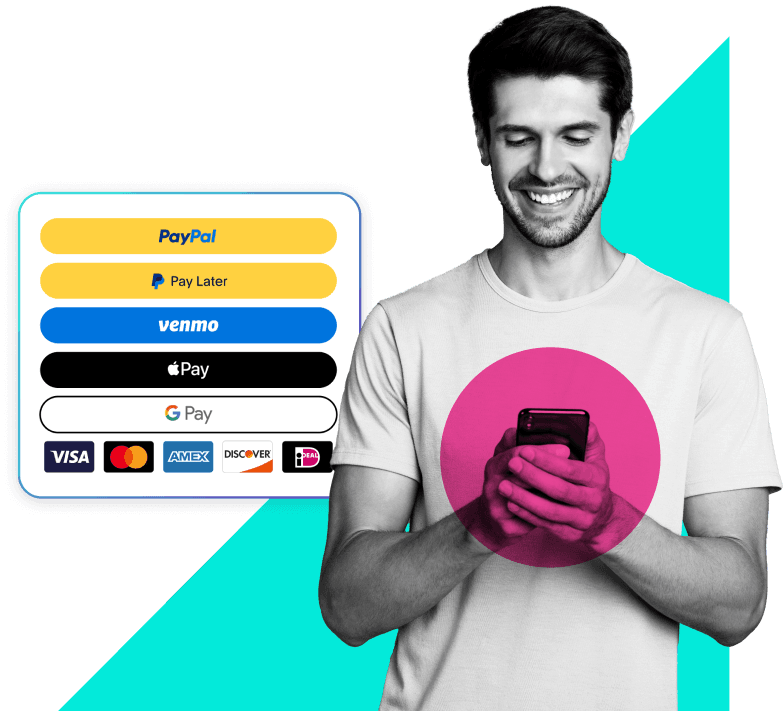

Help maximize your conversion by offering PayPal, Pay Later, Venmo (US), card processing, Apple Pay®, Google Pay™, and country-specific payment methods.

BigCommerce Users

New to BigCommerce?

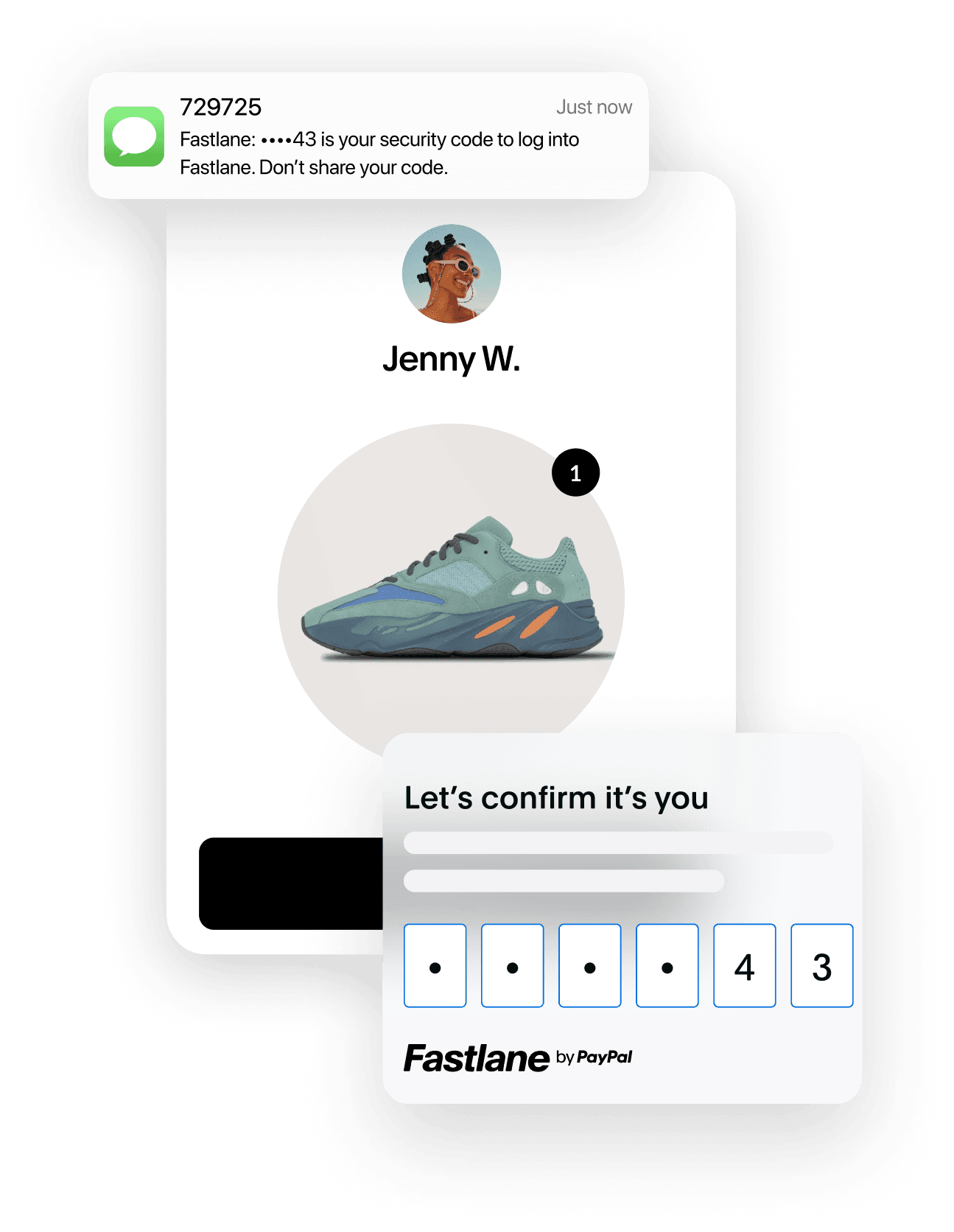

Fastlane by PayPal is here.

Boost conversion with PayPal.

PayPal’s brand recognition helps give customers the confidence to buy. Your all-in-one checkout solution can offer PayPal, Venmo, Pay Later options, card processing, local payment types, and more — all through a single PayPal integration.

46%

higher checkout conversion with PayPal.1

Drive conversion with a fast and simple guest checkout.

Speed up checkout by recognizing millions of guest shoppers and allowing them to autofill their checkout details. No store accounts or PayPal user accounts required.

67%

Fastlane users convert at nearly 67%.2

Current BigCommerce Store? Install Fastlane

Help drive sales with Pay Later.

Allow customers to pay in installments with Pay in 4 and Pay Monthly3 while you get paid up front. Turn on Pay Later messaging to automatically present the most relevant Pay Later option as your customers browse, shop, and check out. With repeat customers making up 66% of all US Pay Later transactions4, it’s no surprise that Pay Later can help attract and retain customers.

55%

higher AOV with PayPal Pay Later (as compared to standard PayPal AOV) for merchants with upstream messaging.5

Pay Later options are available in these countries*

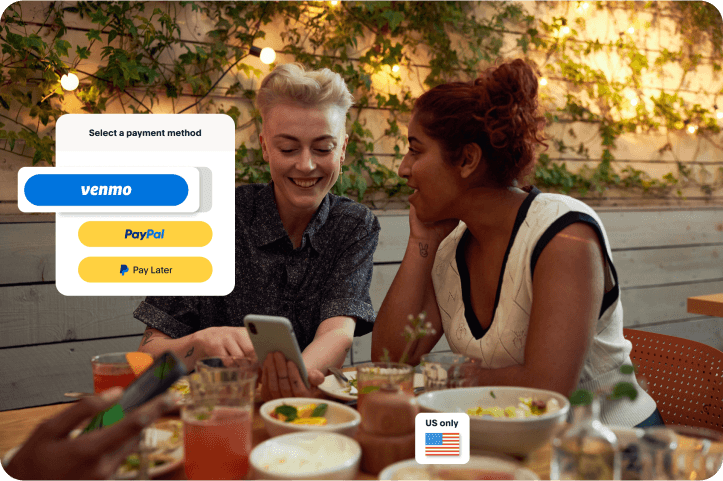

Tap into over 92 million active Venmo accounts.6

Venmo is already part of your integration. Gain appeal to Venmo customers by letting customers pay for purchases the same way they pay their friends. And help bring more visibility to your business with a payment method customers can easily share.

Take charge.

With PayPal, you can process all major credit and debit cards at a competitive rate. By bringing payments under one roof you can simplify reporting and consolidate your settlements to better understand your business.

95%

checkout completion rate for credit and debit card payments.7

Accept Apple Pay and Google Pay.

Apple Pay and Google Pay are part of PayPal’s all-in-one solution so you won’t have to juggle multiple payment providers.

Make repeat purchasing easy.

PayPal enables you to securely save your customers’ payment methods, including PayPal, Venmo, Apple Pay, Google Pay, and credit and debit cards, providing a quick and easy checkout experience.

Create a fast checkout

With their payment info saved, customers can make repeat purchases in just a few clicks, helping you to improve checkout conversion. clicks.

Offer subscriptions

Saving a customer’s payment method allows you to set up recurring payments and charge your customer on a scheduled basis.

Reduce card declines

Card data can be kept current with account updater services to automatically update expired card information to help capture every sale.

Elevate security

Customers' payment information is stored securely by PayPal, helping you ensure compliance and minimize risk.

Bring your online and in-person sales together

From the web to the counter – keep your sales seamlessly connected when you integrate your BigCommerce store with PayPal Zettle’s POS app.

Go global. Make it local.

With country-specific payment methods, you can reach international customers while making your business feel local. Build trust with local payment options that correspond to the shopper’s location.

More reasons to offer PayPal.

PayPal’s size, scale, and volume allows for strong relationships with card networks, issuers, and acquirers globally to help you better serve customers, minimize costs, and drive sales.

Designed with your business in mind

Payment methods

- PayPal, Venmo, and Pay Later options

- Credit and debit card payments processed right on your site

- Apple Pay and Google Pay

- Local payment methods used around the world11

- Funds credit immediately into your PayPal business account while payments process

- Easy to add to your website in just a few steps

Flexible features

- Save customer billing info for fast, convenient checkout

- Mobile-friendly so customers can easily shop on any device

- Drive authorization rates, reduce declines, and help capture every sale

- Track all your transactions from one dashboard

- Help drive authentication and fast checkout rates by saving customer card and billing info with card vaulting

- Real-time account updater automatically updates lost, stolen, or expired card details to help boost conversion

- Add transparency for your card processing expenses with IC++ (Interchange Plus Plus)

Peace of mind

- PayPal helps you handle the risk of fraudulent purchase

- AI-powered fraud detection monitors all transactions

- Package tracking for PayPal and Pay Later helps reduceINRs by up to 90%12

- PayPal Seller Protection on eligible transactions safeguards PayPal Checkout13

- PayPal solutions help you meet global compliance standards

- Additional security offers insights with Fraud Protection on eligible transactions14

- Optional Chargeback Protection to help reduce fraud-related costs15

Venmo is available only in the US.

Google Pay is a trademark of Google LLC.

Apple Pay is a registered trademark of Apple Inc.

*Pay Later is available in US, UK, DE, FR, IT, ES, AU. Product availability subject to local requirements. Merchant and consumer eligibility varies depending on status. Credit checks, fees and other requirements apply and vary depending on product and jurisdiction. See product-specific terms for details.

1Nielsen Behavioral Panel of USA with 29K SMB monthly average desktop purchase transactions, from 13K consumers between April 2022-March 2023. Nielsen Attitudinal Survey of USA (June 2023) with 2,001 recent purchasers (past 4 weeks) from SMB merchants, including 1,000 PayPal transactions & 1,001 non-PayPal transactions.

2Based on PayPal internal data from August 2 to September 30, 2024. Applicable to shoppers who used Fastlane’s autofill.

3Based on an internal data analysis of Pay Later retailers, October 2020 through August 2023. Data inclusive of transactions using PayPal Pay Later products across 7 markets (US UK AU DE

FR IT ES)

4About Pay in 4: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. PayPal, Inc. is a GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee.

Pay Monthly is subject to consumer credit approval. Term lengths and fixed APR of 9.99-35.99% vary based on the customer’s creditworthiness. The lender for Pay Monthly is WebBank. PayPal, Inc. (NMLS #910457): CT Small Loan Licensee. RI Loan Broker Licensee. VT Loan Solicitation Licensee.

5Based on PayPal internal data from Jan 2022 - Dec 2022.

6Paypal Internal Data - 2023

7Based on PayPal internal data from 1st Jan 2022 – 31st Dec 2022.

8In July 2022, PayPal was recognized as the #1 most downloaded finance and banking app globally. **Apptopia, Top 10 Finance & Banking apps, H1 2022. July 13, 2022.

9PayPal Earnings-Q3, 2023, based on PayPal internal data.

10CR (Consumer Reports), "Buy Now, Pay Later Apps Are Popular, but Are They Safe?" Consumer Reports , May 25, 2023.

11Availability may vary depending on merchant’s integration method and geographic location.

12Based on PayPal internal data from Jan 1–July 7, 2023 for “Item Not Received” dispute criteria in

North America (US).

13Available for eligible transactions. Limits apply.

14Available on eligible purchases.

15Chargebacks that are not related to fraud or item not received (INR), such as broken Item, significantly not as described (SNAD), refund not processed, and duplicate charge, are not protected by Chargeback Protection. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments.

MRF-93931