Watch Our Product Tour

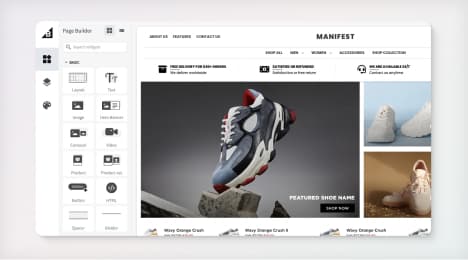

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Payment fraud: What is it and how it can be avoided?

Payment fraud is any type of false or illegal transaction completed by a cybercriminal. The perpetrator deprives the victim of funds, personal property, interest or sensitive information via the Internet.

Payment fraud is characterized in three ways:

Fraudulent or unauthorized transactions

Lost or stolen merchandise

False requests for a refund, return or bounced checks

Ecommerce businesses rely on electronic transactions to charge customers for products and services. The increased volume of electronic transactions has also resulted in an increase in fraudulent activities.

What types of fraud are there?

There are multiple methods of payment fraud:

Phishing: Any emails or websites that require personal or private information such as credit card, bank account or login credentials are prone to phishing. If the source is trusted, such as a partner with a bank, the website is trustworthy. However, if the source is unfamiliar, it could indicate an attempt at stealing information.

Identity theft: Identity theft exists outside of the digital realm as well, but it's a common type of fraud online. A cybercriminal who steals personal information and uses it under false pretense is engaging in identity theft. Hackers penetrate firewalls through old security systems or by hijacking login credentials via public Wi-Fi.

Pagejacking: Hackers can reroute traffic from your ecommerce site by hijacking part of it and directing visitors to a different website. The unwanted site may contain potentially malicious material that hackers use to infiltrate a network security system. Ecommerce business owners must be aware of any suspicious online activity in this capacity.

Advanced fee and wire transfer scams: Hackers target credit card users and ecommerce store owners by asking for money in advance in return for a credit card or money at a later date.

Merchant identity fraud: This method involves criminals setting up a merchant account on behalf of a seemingly legitimate business and charging stolen credit cards. The hackers then vanish before the cardholders discover the fraudulent payments and reverse the transactions. When this happens, the payment facilitator is liable for the loss and any additional fees associated with credit card chargebacks.

How does fraud happen?

Fraudsters have become savvy at illegally obtaining information online. Hackers often pose as a legitimate representative and contact credit card owners asking for sensitive information, then use the following means of interaction to steal personal data:

Texting malware to smartphones

Instant messaging

Rerouting traffic to fraudulent websites

Phone calls

Online auctions

Cyberthieves also work in teams to penetrate network security systems by looking for glitches or patches that haven't been updated in awhile. These gaps give hackers access around a firewall and make it easy to illegally obtain sensitive information.

How can ecommerce businesses mitigate fraud?

While it's challenging to entirely eliminate the threat of fraud for ecommerce stores, you can help protect against it by continually updating your network security systems. Firewalls and antivirus software are designed to act as a shield against hackers' attempts to penetrate a secure network. Constantly updating software helps ensure that your sensitive business information is safe.

There are a number of other ways to protect your business against fraudulent payments:

Maintain awareness of the latest fraud trends

Partner with a verified payment processor

Encrypt transactions and emails containing confidential information

Ensure that tokens and login credentials are regularly changed

Establish a policy regarding access to confidential information

Constantly run security checks with antivirus software

Require customers to log in to an individual account prior to making a purchase

Payment fraud can hurt both you and your customers. By aggressively protecting your ecommerce store against fraud, you can improve your reputation and your bottom line.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo