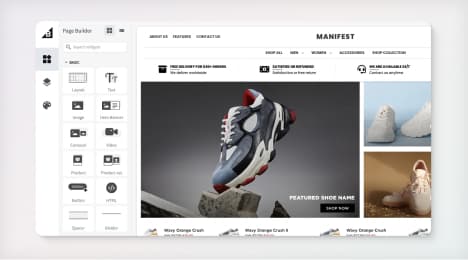

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What are cross border fees?

Considering the explosive growth potential of cross-border ecommerce, an obvious opportunity of an ecommerce business is a borderless marketplace. No longer limited by geography, merchants can market their goods to anyone with an Internet connection and a desire for what they sell, and electronic payments make the process easy and convenient.

But selling in foreign markets comes at a cost. Both merchants and consumers may be surprised to discover extra fees when their credit card statements come in. Visa and MasterCard charge cross border fees to credit card processors, which then have to either absorb the loss or transfer the cost to merchants. Cross border transactions add to the administrative challenges of managing an ecommerce business, including regulatory compliance, increased processing charges and dealing with currency exchanges.

Visa and MasterCard assess two variables when applying cross border fees:

Where is the business registered?

When merchants sign up for a payment processing service, they have to report where the business is registered. Once the business location is registered, all sales that come from within that country will qualify as domestic. Any that come from outside will result in cross border fees.

What is the location of the card-issuing institution?

Once the location of the merchant account is determined, credit card companies figure out where the card-issuing bank is located. If the credit card the consumer uses was issued in a country other than where the merchant is based, he or she may have to pay cross border fees as well.

How are fees assessed?

In earlier years, a fixed pricing model was the standard for ecommerce. Most transactions netted a flat discount rate that never changed, regardless of the circumstances surrounding the transaction. Today, online payment processing is more complex, with fees governed by credit card interchange.

Interchange is a payment exchanged between the acquiring bank to the cardholder's bank that compensates the latter for the cost of processing the transaction, a system credit card companies put in place to distribute the costs and benefits of credit card payments fairly among all parties. Interchanges are set up regionally, as well, and each geographic location has unique characteristics that determine the types of fees paid. In the U.S., there are two different cross border assessment fees.

Domestic cross border charges

Domestic fees apply to transactions acquired within the U.S. that are paid for by a card issued in a foreign country. For instance, a couple from France might visit a restaurant in New York City and pay for the meal using a credit card from their home country. This transaction would prompt a domestic fee. In April 2015, MasterCard raised the fee from .40 percent to .60 percent. Visa calls these charges International Service Assessment Fees (ISA), although it means essentially the same thing. They charge .80 percent on transactions processed in U.S. dollars with a card issued from a foreign bank. These charges are not included in the interchange and Visa's standard assessment fee of .11 percent.

Foreign cross border charges

These fees apply to cross border transactions processed in a currency other than U.S. dollars. MasterCard charges 1 percent for these exchanges and Visa charges 1.20 percent.

Merchants often find it advantageous to sell to foreign customers in their own local currency. It instills confidence in the buyer and reduces confusion about what their real out-of-pocket costs are. Merchants don't even have to open a local account to support the transaction. Instead, a U.S. merchant can charge the cardholder's bank in U.S. dollars. The downside is the cardholder will be charged a cross border fee, which might inspire them to look for local options for their next purchase.

Despite the explosive growth of ecommerce and the ease of selling to global markets, merchants still have to contend with variances between currencies. Cross border fees are an expense, both in terms of money and time, but these costs are often overshadowed by revenue opportunities in international markets. By researching options and creating the best possible fee structure for your business, you can create a highly successful company with brand advocates all over the world.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo