Watch Our Product Tour

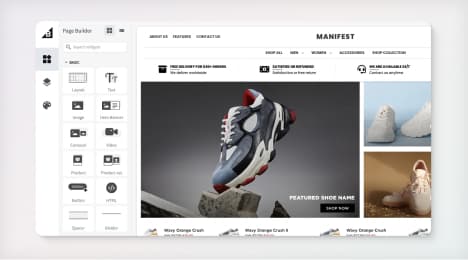

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is an EIN (Employer Identification Number)?

The United States government issues employer identification numbers (EIN) to identify business entities the same way they issue a social security number to identify every US resident. An employer identification number is a unique identifier assigned to a business entity so that the IRS (Internal Revenue Service) can easily identify business entities for tax reporting.

The IRS is responsible for issuing EINs, including information about where the business entity was registered. EINs are sometimes known as FEINs (Federal Employer Identification Numbers). The number may also be your Federal Tax Identification Number (FTIN) if used to identify your business for tax reporting purposes.

The employer identification number comprises nine digits in the XX-XXXXXXX format. Business entities can apply for EINs through the Internal Revenue Service.

If you’re a business owner, especially in the ecommerce space, you need to know about this number because you won’t be able to file business tax returns, apply for a business license or open business bank accounts without one.

Why Should You Get an EIN?

You need an employer identification number if you have employees, need to file certain tax returns or operate as a partnership or corporation. These are some of the rules established by the IRS explaining when one requires an EIN.

Businesses may also need to apply for a new EIN in certain situations. For example, a business that changes its ownership or business structure is usually required to apply for a new employer identification number.

So if you are a sole proprietor and want to incorporate your business, the IRS expects the responsible party to apply for a new EIN.

The responsible party, in this case, is the business or entity owner. The IRS requires that the party be an individual or natural person unless it’s a government entity making the application.

When starting a business, keep in mind that it won’t become operational until you’ve applied for an EIN either by mail, fax, online or phone. EINs are necessary for different types of businesses, including:

Non-profit organizations.

Sole proprietorships.

Limited Liability Companies (LLC).

Partnerships.

Trust.

Self-employed individuals like subcontractors are also required to have an employer identification number. The primary contractor will use the number when reporting the business income paid to that subcontractor to the IRS.

Keep in mind that the IRS requires businesses of all sizes to have an employer identification number. So, it doesn’t matter if you are an ecommerce business with only one employee or a multinational corporation. You’ll need the number for your business to be compliant.

How Can You Get an EIN?

Before you build a website and start promoting your business, you might want to figure out how to get an EIN first.

Fortunately, the application process is quick and easy. Plus, it costs nothing. You can make your EIN application via mail, fax, phone (for those not in the US but intend to do business) or online. You will need to fill out Form SS4 (Application for Employer Identification Number), which you can access through the IRS website.

Some of the information the IRS will require in the application form include;

The name of the business entity’s principal officer.

Personal taxpayer-identification numbers, such as SSN, EIN, or ITIN.

The type of business entity.

The reasons for applying, e.g., have you started a business, purchased a going business, hired employees, etc.?

The acquisition or start date.

The primary industry of business operations.

The highest number of employees you expect in the next 24 months.

Your business must be in the United States or its territories for you to apply for an EIN online. You’ll receive your employer identification number as soon as the IRS validates your data. The process is that simple.

How Can You Retrieve a Misplaced or Lost Employer Identification Number?

Between the busy life of a business owner and the tons of legal documentation that comes with owning a business, losing EIN is actually pretty easy. Fortunately, retrieving the nine-digit number is also straightforward. Plus, there are various places you could get the number.

First, check any tax returns you filed for your business entity. Your employer identification number should be notated somewhere in that document.

The second option is to check for the confirmation mail issued when you applied for the number. Unfortunately, this option is only viable if you stored the confirmation letter properly. Otherwise, consider the other options.

You can also get in touch with your bank to retrieve the number. As stated earlier, banks require EINs to open business bank accounts. Therefore, your bank should have the number somewhere in their records. Besides the bank, you can also contact the agency you used when applying for a local or state license. They should have your EIN as well.

Lastly, you can contact the IRS directly through the business and specialty tax line. That number is 1-800-829-4933. You’ll be asked a few questions to confirm your identity; then, they’ll do a search to retrieve your employer identification number and issue it over the phone.

Keep in mind that the number will only be issued to an authorized person. In other words, a random office assistant cannot receive the number on your behalf. Only the sole proprietor, a corporate officer, a partner in a partnership, executor of an estate, or a trustee of a trust can receive the number.

The Final Word

As a business owner, you simply can’t do much without an employer identification number. You need it for vital functions like filing tax returns, registering state taxes, opening business bank accounts and applying for a business credit card. It becomes even more critical when you have employees.

Getting an employer identification number allows you to keep your business and personal finances separate. Plus, you need it to maintain a corporate veil that protects you from personal liability for the company’s debts. Separating your personal and business finances also helps shield you from identity theft.

Hopefully, now you have a better idea of what an EIN is, how critical it is and how to apply for one.

Author: Michal Leszczyński

Michal is immersed in developing, implementing, and coordinating all manner of content marketing projects as the Content Marketing Manager at GetResponse. He has 8-plus years of expertise in online marketing with a Master of Science Degree in Strategic Marketing and Consulting from the University of Birmingham (UK). Michal is the author of more than 100 articles, ebooks, and courses for both GetResponse and renowned websites like Crazy Egg and Social Media Today.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo