Watch Our Product Tour

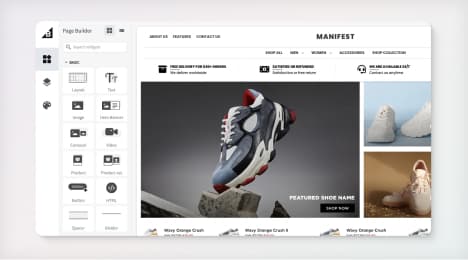

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

How to choose a payment processor

If you have an ecommerce website, selecting your payment process is one of the most critical decisions you’ll make for your business. Allowing your customer the option to pay by credit or debit card requires that you have a payment processor. A payment processor is a company that acts as a mediator, moving money from your customer’s bank account or credit card to your bank account.

Ecommerce is enjoying a high that is expected to outlast the pandemic. With brick and mortar stores closing down due to the lockdown, people are even doing their groceries online. You might have heard of click and collect or bopis.

What is bopis? It’s an online payment system where consumers can ‘buy online and pick up in store’. With all retail needs being met online, the already vast payment processing market is growing too.

Choosing the right payment processor is critical because there are many market players to choose from, and pricing is also a factor. You need to select a suitable payment gateway to support your shopping cart software and fulfill your business needs.

What Does a Payment Processor Do?

A payment processor authorizes payments and processes them for your online store. The process mapping for the payments to be handled securely includes several steps that are the responsibility of the payment processor:

It will verify the customer’s billing information, i.e., validate credit card details.

It makes sure the right amount of funds are available and authenticates funds for each payment.

It approves payment requests. The order confirmation number is made available after this step.

It approves transactions and transfers funds to your merchant account and then your bank account.

All these transactions need to take place in an encrypted payment processor server, so your customer’s sensitive bank account or credit card details are secure. A merchant account is a temporary holding account that receives the payments from the customer’s bank.

The Top Factors to Consider

1. Keep costs as low as possible.

The payment processor offering the lowest prices isn’t necessarily the best partner to have. Cost still remains a critical aspect because we all want to keep overheads as low as possible. The following costs are involved with payment processing for every transaction. This is in addition to a monthly and set up fee.

· Interchange: The fee your customer’s bank charges.

· Assessment: The credit card association also charges a pre-negotiated percentage fee.

· Markup: The percentage charged by the merchant bank.

· Processing: The fee charged by the payment processor.

Keep all of the above fees and charges in mind before you make your decision. Your decision should also depend on the volume and value of your transactions. If you have high-value transactions, look for a payment processor that charges a set monthly fee and low transaction fee. Remember to watch out for hidden fees.

2. Provide multiple payment options to boost your sales.

Your payment processor should let you pick the types of services you would like to offer your customer without restriction. By providing multiple e-commerce payment options, you extend your reach, and every prospective customer will be able to find a service to match their preference. In the interest of sales enablement, having multiple payment options is an effective tool to boost customer interactions.

If a customer isn’t keen to use their credit card online, having the option of debit or bank transfer will increase their chances of completing an order. Many people don’t even have a credit card, so not catering to that sector of the market means losing out on a sizable amount of customers.

3. Secure your site against fraud.

Credit card fraud is rampant. It’s a severe concern for you and your customers. When choosing a payment processor, have a look at the fraud protection services they offer. Find a secure and reliable service that flags and denies risky transactions. Data should be encrypted during the transaction, and any data stored should be encrypted as well.

Financial information is sensitive, and there is no coming back from a data breach. The security of your payment gateway is the payment processors’ responsibility, so hire one who adheres to the highest data security standards. To avoid any fraudulent transactions, ensure your payment processor has fraud detection screening tools on the menu.

Other Factors

An e-commerce business can present many challenges, whether in retail inventory management, web design, or payment processing. Each facet of an online business is complicated. Find a payment processor that, along with the above, gives you fast access to your funds, provides round the clock customer service, and is honest and helpful.

Compare a few payment processors and choose the one with the expertise and support you need for your online transactions. The right payment processor can make a world of difference for your ecommerce business.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo