Watch Our Product Tour

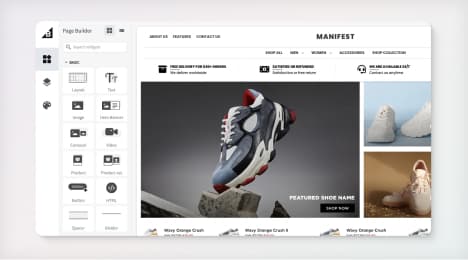

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

How to choose which credit cards to accept in ecommerce

Ecommerce businesses must accept credit cards as forms of payment. Online store owners are free to choose which credit cards are best for their shoppers to use. This decision is entirely up to the business owner and needs to be based on thorough research and financial status. There are perks to accepting certain cards and drawbacks to accepting others.

Merchant accounts and payment gateways

First and foremost, ecommerce businesses need a merchant account and a payment gateway to accept credit card payments online (1). Banks provide enterprises with merchant accounts after business owners apply for them, similarly to loans. The bank then extends a line of credit to the company. There are often initiation and monthly fees associated with merchant accounts.

Payment gateways are corporations that handle online transactions and credit card payments. They connect the buyer's bank account to the business's merchant account. Ecommerce businesses need both to accept credit cards. Payment gateways often charge monthly fees, as well.

In fact, fees are the biggest determining factor for ecommerce shop owners when deciding which credit cards to accept.

Visa and MasterCard

Visa and MasterCard are widely accepted, and it is highly recommended that ecommerce businesses allow customers to use these cards as forms of payment. These two corporations are credit card processors (2). They do not issue cards directly. They work with a variety of banks to offer users debit cards, credit cards and checking accounts sponsored by the Visa and MasterCard brands. These companies make money on transactions carried out with their sponsored cards. During a credit card transaction, Visa and MasterCard work with acquiring banks, issuing banks and the network connecting the two to complete payments.

The good thing about accepting Visa and MasterCard is that their per-transaction fees, which are small amounts of money charged to the ecommerce merchant, are typically lower than other credit cards. They usually charge vendors about 2 percent of the transaction price.

American Express

American Express is accepted less frequently than Visa and MasterCard. It is a premium rewards cards that falls into a more exclusive card bracket.

AMEX is a card issuer that does not partner with banks to provide consumers with credit cards, debit cards or checking accounts. AMEX cards are marketed directly to people and businesses. AMEX card holders are typically more secure in their finances and the scope of people with these cards is much narrower than Visa and MasterCard.

American Express also charges higher per-transaction fees. Merchants are charged closer to 2.89 percent each time a consumer with an AMEX card makes a purchase. This increase can add up to great sums over time and makes a big difference for ecommerce business owners. If an ecommerce business wants to include AMEX card holders in their consumer pool, a monthly fee may be a possibility (3). This way, vendors only pay a flat rate, as opposed to per-transaction fees.

Discover

Discover is another card ecommerce businesses should consider accepting as a form of payment. Discover is a leading direct bank and payments partner with acceptance at 42 million merchants. It issues the Discover card as well as runs the Discover Global Network, which includes the Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in more than 185 countries and territories.

With more and more payment options available to consumers, it’s critical merchants consider all forms of payment to ensure a positive customer experience. In fact, a previous Discover study found that 24 percent of U.S. consumers abandon their shopping cart when their preferred payment option is not offered, and 50 percent of online shoppers surveyed listed a variety of payment options as an important factor when checking out online.

Additional fees

It's important to note that credit card processing fees can fluctuate and come from unexpected places. Debit and credit card processing fees may vary, even if the card processor is the same. Whether a merchant enters a card number manually or swipes it through a machine can affect the fees associated with the transaction.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo