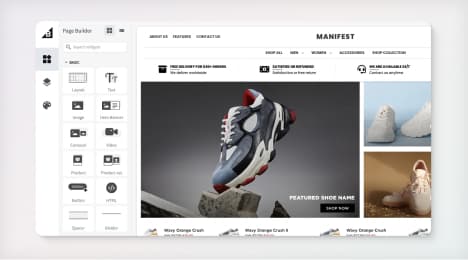

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is an LLC? Online business and Limited Liability Corporations

Definition: An LLC (Limited Liability Company) is a legal status of a commercial entity that combines the limited liability feature of corporations with the tax and flexibility advantages of a partnership. A single individual, multiple individuals, corporations or even other LLC businesses can be LLC members.

The Advantages and disadvantages of LLC Status

Many single-owner ecommerce start-ups opt to register as an LLC rather than operate under a sole proprietorship, and many multi-owner online companies that could choose partnership status choose LLC status instead. The advantages of being an LLC listed below also hold true for many brick-and-mortar businesses:

**Tax advantages:**Corporations are taxed entities, but LLCs (like partnerships) have all profits and losses "passed through" the business to its members. This means that each member pays taxes on his share of the profits on personal tax returns.

**Limited Liability:**Like a corporation, personal assets of members are, for the most part, exempted from any liability for decisions of the business. This reduces the risk to members if the business is buried in debt or sued.

Less Paperwork and Fees: An LLC eliminates much of the paperwork corporations must file, and the cost of registering an LLC is less than for corporations.

Greater Flexibility: Members are free to split up profits almost any way they wish, normally based on capital and work contributed to the business.

**Greater Credibility:**The fact that the business is registered with the state and bears the LLC suffix often makes customers feel safer doing business with a company.

**Owning a Name:**Registered LLCs own the rights to their business' name, barring anyone else from using it.

A few of the most notable disadvantages of being an LLC are:

**Frequent Dissolutions:**State laws often provide that LLCs are dissolved once any of its members withdraw from the agreement. It is possible to re-register again as a new LLC or to put provisions in the original contract to prevent dissolution, but all LLC closures must be registered with the state and all assets disbursed among members.

Higher Personal Taxes: While business taxes are eliminated, if the LLC becomes extremely profitable and the members remain few, high self-employment taxes could result.

Start-up Costs: While cheaper to start than a corporation, LLCs do have fees that make them more costly to initiate than sole proprietorships or partnerships.

How to Form an LLC

Each state will have minor differences in how to form an LLC, but the basic steps are as follows:

Choose a Name for the New Business: The registered LLC name must differ from other LLCs in the state, avoid any restricted words, and end with "LLC" or "Limited Company."

**File "Articles of Organization":**This means filing a document with basic information on the company, such as its name, location, and its members' names.

**Establish an "Operating Agreement":**This refers to an agreement that outlines the business' finances and structure. It is not usually mandatory, but highly recommended.

Obtain Licenses: Once registered, the LLC will need all licenses and permits applicable to the business type and the state or locality.

**Make an Announcement:**In a few states, a formal announcement of the new LLC's existence is required in a local newspaper.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo