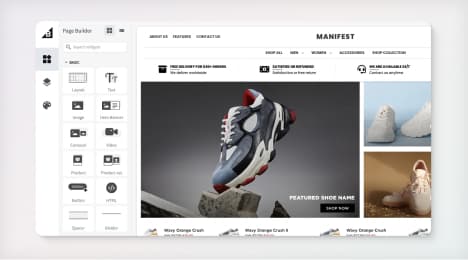

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is an SBA Loan?

Any small business owner can tell you how important it is to have financing on hand when starting or growing a business. The problem? Affordable terms on a small business loan are hard to find.

That’s where an SBA loan comes in handy. Business loans backed by the Small Business Administration come in a variety of forms, but their common goal is simple: To help small businesses access the kind of funding that larger businesses obtain more easily—loans with low interest rates, long repayment terms, and many use cases.

Because SBA loans are highly sought-after, they’re also competitive and have stringent requirements and minimum qualifications. With that in mind, let’s review what SBA loans are, why they’re so useful, and what’s needed to obtain one.

Defined: SBA Loan

SBA loans are business loans that are backed by the SBA. The SBA itself doesn’t disburse the loan—instead, the agency guarantees up to 85% of the loan amount provided through an SBA-approved lender, which are typically banks or nonprofit lenders. With the SBA’s backing, the bank more readily approves a small business for a loan with a reasonable interest rate, low down payment, and long repayment term.

These loans come in many forms, though the most popular include the SBA 7(a) loan, the SBA 504/CDC loan, and the SBA Microloan. Uses for these loans include working capital, expanding your business, purchasing equipment, and more.

Advantages of an SBA Loan

SBA loans are arguably the most sought-after lending product on the market for small businesses. Why? In many ways, they are the perfect financing middle ground for small business owners. Some programs are also flexible in how you can use your loan proceeds, and the loans themselves are secured.

1. Designed for small businesses.

Banks are often reluctant to fund small businesses, which are riskier bets than larger corporations, and require extensive underwriting for smaller loan amounts.

Conversely, online lenders have more relaxed requirements and are willing to fund younger, smaller businesses with lower credit scores, typically offer loan products at higher interest rates as a result of the risk they assume.

SBA loans are the perfect middle ground, as they give small businesses bank loan-type funding at rates that are affordable and encourage growth and repayment.

2. Multiple uses of funds.

Some SBA loan programs have different rules around use of proceeds, but just taking the popular SBA 7(a) program for example, a recipient can use that loan for expansion and renovation, for new construction, to buy land or buildings, to buy equipment, as working capital; to refinance debt for compelling reasons, and more. Additional programs allow you to finance long-term fixed asset purchases, use the loan as a seasonal line of credit, and other uses.

3. Secured loans.

SBA loans typically require collateral, but that’s not a bad thing. In fact, it’s virtually impossible to find an unsecured small business loan (i.e. one without some form of collateral) that comes with reasonable interest rates. And by offering up collateral, you are able to tell the bank what you’d like to offer up as payment if you for some reason default on the loan—rather than leaving it up to them.

Cons of an SBA loan

That all being said, SBA loans can have their drawbacks for some small business owners. These are mostly centered around the fact that SBA loans are difficult to obtain under certain circumstances.

1. Strong personal credit score required.

As is the case with most business loans, SBA lenders will use your personal credit score to evaluate your business’s qualifications. Though each bank may have different specific requirements, a good-to-excellent score (680 and above) is often needed to qualify for an SBA loan.

2. Two plus years in business needed to qualify.

With the exception of one SBA loan (the SBA Microloan), SBA loans are not accessible for new businesses. You’ll need at least two years in business to qualify for many programs.

3. Specific eligibility requirements.

There are other requirements you’ll need to meet to obtain an SBA loan besides good credit and a certain amount of time in business. For example, lenders may ask you to demonstrate your ability to repay the loan, or to show how this loan will help you enter a new market. The application and underwriting process for an SBA loan is often measured in weeks and months for this reason.

What are the Different SBA Loans?

As mentioned above, there are different SBA loans that cater to specific business types, needs, and industries. You may qualify for one SBA loan program over another, or find that one is a better fit for you. Let’s review them.

1. SBA 7(a) Loans.

This is the most popular SBA loan program, as it has the most use cases and is well-funded and publicized by the SBA. SBA 7(a) loans are available in amounts up to $5 million, to be repaid over 10-25 years.

2. SBA 504 Loans.

Another popular loan program that is best suited for businesses seeking to purchase major fixed assets such as buildings or land, with loans up to $5 million and low down payments.

3. SBA Microloans.

Microloans are small loans—ranging from $500 to $50,000—that new and disadvantaged business owners can use for a number of purposes. Repayment terms do not exceed six years.

4. SBA Community Advantage Loans.

Community Advantage loans are disbursed through mission-focused lenders (CDFIs, CDCs, micro-lenders or SBA Intermediary Lenders targeting underserved markets) but are otherwise similar to 7(a) loans.

5. SBA CAPLines.

CAPLines function as an SBA line of credit that business owners can use to finance seasonal or short-term working capital needs.

6. SBA Export Loans.

Export loans are short-term working capital loans for exporters, which the SBA monitors to ensure lenders offer reasonable interest rates.

7. SBA Disaster Loans.

The SBA also offers a loan program for businesses that have been affected by a disaster, such as a hurricane or flooding, or the novel coronavirus pandemic. Only businesses in specific disaster-declared zones can apply for this low-cost financing.

Conclusion

If you’re a small business owner seeking financing to help start or grow a business, there are few better options than an SBA loan. Though the application process can be difficult, the results are worth your time. To get started, find an SBA-approved lender to discuss what documents and paperwork you’ll need to provide.

This blog post was contributed by Randa Kriss, senior staff writer at Fundera

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo