Omnichannel

Maximize demand and sales across all channels.

BigCommerce and Feedonomics have redefined omnichannel commerce with powerful tools designed to reach more people and drive more sales. Create seamless experiences that convert across 150+ leading marketplaces, social commerce and advertising channels.

BigCommerce + Feedonomics: Sell More Everywhere

28% of the top 1000 online retailers power omnichannel with Feedonomics

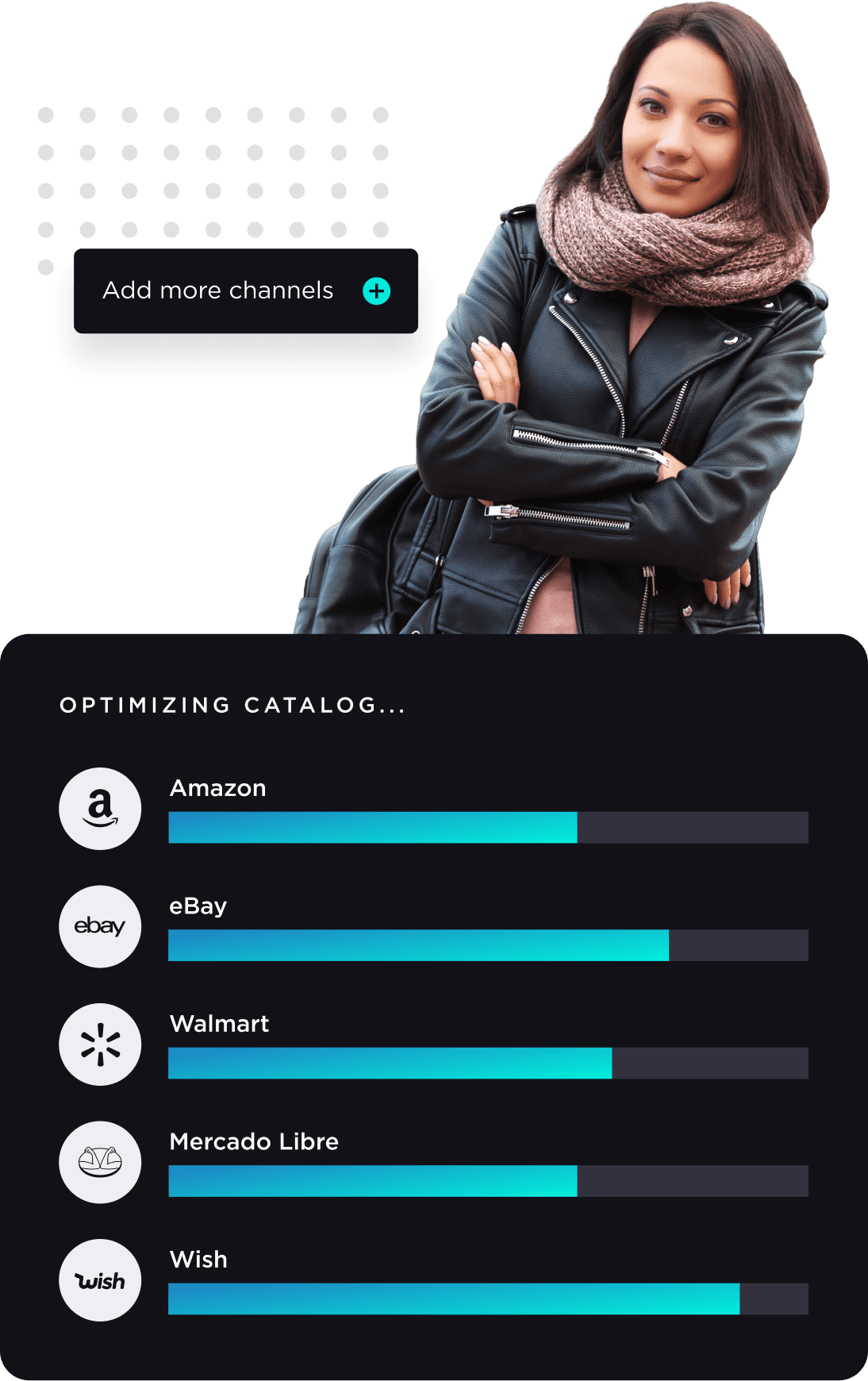

BigCommerce and Feedonomics have partnered to create the ultimate omnichannel selling experience, automating and optimizing your product catalog across channels. In fact, the average Feedonomics customer adds nearly two new channels after they get started, and saves more than 20 hours per month on feed management.

- Boost discoverability with feed optimization and syndication tailored to each channel

- Save time with unified feed and order management

- Reduce listing errors with data governance

- Boost revenue and grow your global footprint by listing on more channels

- Get dedicated support with feed experts

Take your product listings to over 150+ global channels

Marketing across three or more channels earns 250% higher engagement. Use best-in-class tools like Feedonomics and Codisto to sell, advertise and grow across digital marketplaces, social commerce and search engines. Plus, leverage Feedonomics’ FeedAi™ and FeedDNA™ to automatically categorize products and boost channel performance.

Marketplaces

Retailers selling through an ecommerce site saw 58% revenue growth after adding a marketplace. Display your products across leading marketplaces like Amazon, Walmart, eBay, Etsy and more. Wherever you manage your listings, we have a solution — manage from BigCommerce using Codisto, or manage from your company's central operations using Feedonomics.

Social Platforms

One in three global shoppers have purchased through social media in the past year. Increase brand awareness and drive sales on the most popular social platforms like Meta (Facebook and Instagram), TikTok and more. Using Feedonomics ensures your listings perfectly match the requirements of each social channel.

Search Engines

40% of online transactions originate on search engines. Showcase your products on Google, Microsoft Bing and Yahoo, the leading search engines. Plus, with Feedonomics your listings have clean titles, detailed attributes and accurate categorization for peak performance.

Buy Online, Pick Up in Store

Blend brick-and-mortar shopping seamlessly with modern ecommerce.

Omnichannel Case Studies

TRADELINK

Australia's oldest plumbing merchant saw a 346% increase in customers, a 373% increase in orders and a 338% increase in revenue.

Badgley Mischka

With the combination of BigCommerce and Feedonomics, this iconic fashion brand increased revenue by 61% and AOV by 31%.

Harness the power of omnichannel ecommerce

Reach the right shoppers, at the right place, at the right time to unlock digital growth.

Strengthen brand engagement on every channel, across multiple storefronts.

Stand out from the competition and deliver a consistent customer experience on leading marketplaces and social commerce channels. BigCommerce has seamless integrations to Google, Meta (Facebook and Instagram), TikTok, Amazon, Walmart, eBay, Wish and Mercado Libre. Plus, with Multi-Storefront technology, easily create and manage multiple brands, segments or regions from one BigCommerce dashboard.

Sync inventory and avoid over-selling no matter where you make a sale.

Over-selling inventory causes massive delays in delivery and erodes brand loyalty. All omnichannel integrations are built on BigCommerce’s powerful APIs to sync inventory from 3rd-party channels to the back-end, and then off to your ERP or tech stack as needed.

Merge offline and online sales, inventory and accounting.

Quit manually merging sales channel data for a holistic business view. Instead, use one of BigCommerce’s point-of-sale partners like Zettle, Clover, Square, Heartland Retail, and others to automatically sync brick-and-mortar sales, inventory and orders to your back-end.

BigCommerce Omnichannel Guide: Discover Winning Strategies for Omnichannel Success

Resources & Blog

How Omnichannel Retail is Leading Commerce

Learn how a strong omnichannel strategy will ensure you deliver a consistent brand experience.

Unlock Retail Growth in Latin America

Explore six ways Mercado Libre can simplify cross-border selling to expand your business.

How (and Why) to Sell on Walmart Marketplace

Have you considered selling on Walmart Marketplace? Learn how to get started with our insider’s guide.

Omnichannel expertise from our trusted agency partners

Build and scale out SEM and paid social campaigns with leading experts to build new sales channels or train your internal team. BigCommerce digital agency partners bring you certified expertise to help take your new channels to the next level.

“We helped Hisense achieve significant scale and launched their website in one month. They launched their direct B2C business and then scaled it to Amazon, eBay NewEgg and Walmart. We can do a site from concept to launch in four weeks – it’s 50% faster. With other platforms, we would spend a lot more time trying to configure it.’’

Jessica Lago Manager of Marketing & Partnerships

“These pre-built integrations do wonders for our clients. With other platforms we needed custom integrations for some of these products.”

Kevin Harman Founder & CEO

Questions about how we can help your business?

Our sales, consulting, and support teams are available via phone, live chat and email.

Bigger than you need right now? Start with BigCommerce Essentials.