Ecommerce Payment Processing 101: A Beginner’s Guide for Small Businesses

Opening your ecommerce store is exciting. You’ve created and sourced your products, you’ve built an awesome website, and now it’s time for one of the most important steps — getting paid.

Understanding how ecommerce payment processing works is a crucial part of opening an online business. But let’s be honest, if you’re not a financial wizard or very technical, you might find the whole concept of ecommerce credit card processing complex and hard to navigate. The good news is that we’re here to break it down for you.

In this blog, you’ll learn how gateways and payment processors work together, and we’ll share some examples of payment solutions you can use when setting up your BigCommerce store.

Online Payment Methods

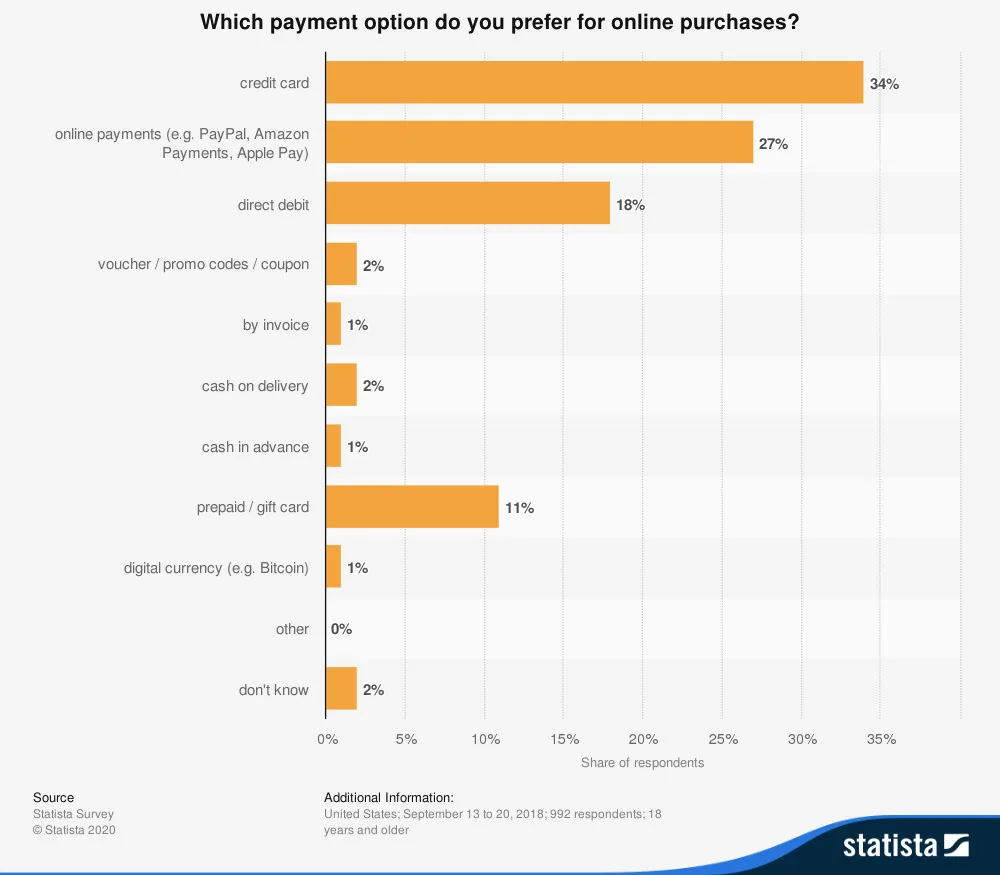

Before we get into how payment processing works, let’s review some of the different payments methods customers prefer for online purchases:

Credit Cards: One of the most popular and straightforward ways to pay both offline and online.

Direct Debit: Customers can enter their bank account details, making this the equivalent of paying in cash or by check.

Alternative Payments Methods: This includes wallets, like PayPal, Amazon Pay, Google Pay and Apple Pay, and buy-now-pay-later solutions, like Affirm, Afterpay, Klarna and Sezzle.

Digital Currency: A very small number of people do pay with Bitcoin or another cryptocurrency.

There are a few other options you can give your customers for paying online during the checkout process, such as ACH and invoicing. However, as you can see from the chart below, credit cards, alternative payments and direct debit are the ones most people prefer.

Three Elements of Ecommerce Payment Processing

Now that we know what types of payments you can choose to offer on your online store, it’s time to talk about payment processing. While there’s definitely more to it than this, an easy way to summarize the concept is to quickly define each of the elements:

Payment gateways: act as the courier between your ecommerce website where the customer enters their payment information and your payment processor

Payment processors: take the information from the gateway, verify that the customer has the funds, and deposit the money in your merchant account

Merchant accounts: receive the funds once they are processed

Sometimes people use the words gateway and processor interchangeably even though, technically, they do different things, making it extra confusing.

Additionally, payment service providers (PSP), also called merchant service providers (MSP), can manage the complete end-to-end process, from the technical connections to depositing funds. (We’ll provide some example PSPs that BigCommerce merchants can use below.)

How Do Ecommerce Payment Processors, Gateways and Merchant Accounts Work Together?

Now that we’ve explained each element, let’s review the steps for a standard transaction to see how the payment systems work together once the customer is finished adding items to their shopping cart:

Step 1. The customer enters their credit or debit information at checkout.

Step 2. The payment gateway secures the data and sends it to the payment processor.

Step 3. The payment processor checks with the credit card network to ensure that the customer has the funds to cover the purchase.

Step 4. The customer’s credit card issuing bank either accepts or rejects the payment request.

Step 5. The payment processor then sends the results (approved or denied) through the payment gateway, so the customer can view on the merchant’s website if the transaction was approved.

Step 6. The payment processor issues the funds to either the merchant account or the merchant’s bank.

What’s sometimes most surprising is that the whole process takes place in a matter of seconds — even though a lot of things are happening.

Let’s go into more detail about how payment gateways work on your BigCommerce store to collect and secure your customer’s payment information.

Collecting Information with Ecommerce Payment Gateways

As we stated above, the main role of the payment gateway is to connect the customer’s payment information with the financial institutions that are actually processing the payment. For small business owners, there’s four main options for collecting payment details on your BigCommerce store — some more customizable than others.

1. Hosted widgets.

In this scenario, you use an HTML component to display information on your checkout page. And there are two types of hosted widgets you can use:

Embedded iFrame components: The content displayed on your checkout page is hosted outside of BigCommerce; therefore, you can’t control the look and feel.

DIV components: The content displayed on your checkout is hosted inside BigCommerce and can be dynamically generated by javascript.

2. Hosted fields.

Using hosted fields is another solution to keep your customer on your checkout page while providing an extra layer of security for their credit card information.

With this option, the form fields are hosted outside of BigCommerce but displayed on the checkout page. The gateway tokenizes the shopper’s credit card information once it’s entered into the fields, and then the token is passed to the payment processor. This way BigCommerce doesn’t handle the raw credit card data.

3. Native hosted component.

For this option, the customer remains on the page and the fields are rendered by BigCommerce on checkout. Then, BigCommerce uses a server-to-server (direct) API integration to connect with the PSP. You can make this work with PSPs like Authorize.net and Cybersource.

Important Considerations for Ecommerce Payment Processors

Once you’ve collected and transferred the data, it’s time for the payment processor to actually process the payment. This is where the majority of the activities happen, from checking with the credit card company and authorizing the payment to transferring the money into your account.

Here’s some general things to know about your payment processor:

1. They should be PCI compliant.

Any company that accepts, processes, stores or transmits credit card information must be compliant with the Payment Card Industry Data Security Standard (PCI DSS). This means that you and your payment processor must comply with these requirements.

When reviewing payment processors, make sure you ask them about their approach to PCI compliance. You can learn more about how to achieve PCI compliance from Jon C. Marsella, the Founder and CEO of Jasper.

BigCommerce stores come standard with Level 1 PCI compliance, so you’re covered if you’re working with one of our Partners listed in your Control Panel.

2. They should create tokens for sensitive payment information.

We touched on this above, but it’s worth explaining how it works in more detail. Essentially, to secure your customer’s payment information — especially if you allow customers to save their payment information to use for repeat purchases or recurring billing— your payment processor should use tokenization.

How this works is that the moment the credit or debit card information is captured, the processor converts the account numbers into a token that it can use to identify the specific customer. By doing this, you’re protecting yourself and your customers from hackers that might attempt to steal sensitive payment information.

Depending on your BigCommerce plan and the payment service provider you choose, you can enable stored payment methods for your customers. To learn more about how this works for BigCommerce merchants, visit our knowledge base.

3. The payment methods they accept.

This is probably the most important feature of your payment processor — at least to your customers. Does it allow you to accept the payment methods your customers want to use?

For instance, while Visa and Mastercard are widely accepted all over the world, it’s a very different story for American Express and Discover. Additionally, if your store sells more expensive items, customers might prefer an option, like Klarna, to break up the payments or buy now, pay later. You want to give customers as many options as possible to ensure they complete their purchase.

4. How much they charge in fees.

Now, this is probably the thing you care about most. As a small business, you don’t want to get trapped into paying astronomical fees for your payment processor, but sometimes the fees can be difficult to understand.

Typically though, companies will charge a percentage, as well as a fixed fee per transaction. However, some may charge a monthly fee for a subscription instead of transaction fees. There are also extra fees you might be required to pay for things like chargebacks, disputes and international payments.

Knowing your number of transactions can help you estimate your costs and find the right type of payment processor for your ecommerce business. If you’re a BigCommerce merchant, you can take advantage of our pre-negotiated rates with PayPal powered by Braintree.

Do You Need an Ecommerce Merchant Account?

Between the heightened complexity and modernization of ecommerce, some businesses are recognizing the need for ecommerce merchant accounts to help tailor their offerings to consumers’ expectations.

If you manage payments digitally — and if you’re here, you probably do or plan to — an ecommerce merchant account can help you offer the right digital payment options for your customers.

Merchant accounts can also help you manage and reduce the fees associated with various payment gateways.

Finally, ecommerce merchant accounts are focused on making their services very secure and now use the highest grade encryption when processing payment. This helps you ensure you’re offering customers the most accurate and secure environment for them to complete their card transactions.

7 Examples of Ecommerce Payment Solutions

At this point, you should have a better understanding of payment gateways, payment processors, merchant accounts — and how they all work together. Now, we can review some examples of PSPs that offer payment processing services, as well as gateways and merchant accounts.

1. PayPal.

PayPal is built on powerful technology that lets you easily accept credit and debit cards, offer PayPal to your customers, and extend buy now, pay later options, including Pay in 4 and PayPal Credit through your online store. Through PayPal, you can also enable payment through Facebook, Pinterest and Instagram.

2. Stripe.

In addition to offering fast, easy and secure payment acceptance, Stripe works with Google Pay, Apple Pay, and Masterpass to offer your customers even more payment options on cart and checkout pages. Stripe is PCI-certified and accepts international transactions from customers worldwide, ranging from Germany to Japan.

3. Square.

Square enables you to sell online and in-person with two-way inventory sync and provides a robust suite of tools to help you grow your business and improve your operations, including payroll and time management, employee-specific access management, customer engagement, and online invoices.

4. BlueSnap

BlueSnap is a single global platform to accept payments from anywhere and on any device, offering global payment processing and multi-currency support — supports over 100 currencies and shoppers can select from 16 different payout currencies — in just one account.With BlueSnap, merchants can accept major credit card payments, as well as regional cards like China Union Pay. You’ll also get world-class security and detailed analytics and reporting.

5. Amazon Pay.

Amazon Pay simplifies checkout for hundreds of millions of Amazon customers by enabling them to use payment and shipping information stored in their Amazon accounts. According to Amazon, some merchants who use Amazon Pay have experienced increased conversion, reduced cart abandonment and faster checkouts. Amazon Pay offers fraud detection technology and also offers Amazon’s A-to-Z Guarantee on qualified orders. And mobile checkout takes just a few taps.

6. Klarna

With Klarna you can offer no-liability financing options at checkout, including build-in fraud protection.

7. Sezzle

Sezzle’s mission is to financially empower the next generation. Sezzle allows shoppers to split orders into 4 interest-free payments over 6 weeks in over 44,000 online stores. With no impact on credit score and free payment reschedules, it’s a convenient and easy-to-manage payment option for your customers.

Conclusion

Now that you understand the available options to accept payments through your ecommerce platform, you’re well equipped to make decisions about which one(s) you’ll select.

Whether you’re just starting out or a fully established business, payments are a core component of your success. There’s no shortage of options for you to choose from — but you need a payment processor that addresses your specific needs as well as those of your customers. The price you’ll pay as the merchant is important, but it’s not the only factor. Consider all the features you need for your business right now, as well as what you might like to have as you start to scale.

Whatever online payment processing solution you choose, make sure it enables online transactions that are easy for both you and your customers.

Shelley Kilpatrick is an accomplished content marketer who creates compelling, original content designed to educate and empower ecommerce businesses. She is currently Senior Manager of Content Marketing at BigCommerce where she leads a world-class team of content writers and strategists. Outside of work, she loves exploring all things Texas BBQ and craft beer with her husband and two dogs.