If you want to expand your ecommerce business in 2023, online marketplaces are a must.

From 2017 to 2022, retail ecommerce sales in the United States more than doubled, jumping from $425 billion to more than $875 billion.

This growth in ecommerce business has a direct impact on all kinds of companies. According to Malcolm Smith of Bloomforth, 55% of the businesses selling on marketplaces have profit margins over 20%.

At the same time, another poll indicates that 43% of small businesses experience sizable revenue growth with online sales.

Before you jump into the online marketplace — and ensure as much profitability as possible on these platforms — you need to first identify the best online marketplaces for your brand.

Each online marketplace has its own unique requirements, product categories, listing fees and audiences. If you want to ensure you’re making the right decision, some upfront research is necessary.

You’ll want to understand the different strategies for marketplace sellers, which ones hold the most promise for your products, and what you need to do to ensure a smooth start.

In this deep dive, we’re covering all the need-to-know essentials.

Online Marketplace Options for All Types of Growth

At its core, an online marketplace is an ecommerce site that offers many different products from many different sellers. Some of the most well-known marketplaces include:

Amazon.

Walmart.

Mercado Libre.

eBay.

Wish.

Etsy.

Alibaba.

Google Express.

However, these are far from your only options.

There are also niche online marketplaces like Bonanza and Fruugo and Hollar, fashion-focused marketplaces such as Zalando and Fullbeauty, bargain-focused marketplaces such as Tophatter and Tanga… and the list goes on.

In fact, there are now more than 150 online marketplaces you could potentially leverage to reach new customers doing their online shopping — both within the United States and overseas in areas like Japan and Europe, with trillions of dollars in revenue potential to tap into.

It is a lot to consider but remember: you don’t need to go after them all at once. You just need to determine which channels are the best fit for your brand.

First, let’s back up and discuss why you should consider becoming a third-party seller in the first place.

Sell more, however your customers shop.

Seamlessly blend brick-and-mortar with ecommerce when you unlock Buy Online, Pick Up In Store (BOPIS) functionality on BigCommerce.

The Biggest Benefits of Selling on Online Marketplaces

With the ever-increasing popularity of ecommerce marketplaces and online sales, these channels are constantly coming up with new ways to keep customers happy.

That is great news for third-party sellers.

It means most marketplaces will go to great lengths to make it as easy as possible for brands and retailers to market, sell and fulfill.

Why? Because the easier it is for you to use the platform, the better the experience will be for shoppers — and the more likely they’ll be to keep coming back for more.

This takes shape in three particularly attractive advantages:

Fast to launch.

If you’re new to selling online, marketplaces can be an excellent way to generate revenue and build your brand as you work to drive traffic to a new ecommerce website. Once approved as a third-party seller on marketplaces, you simply upload your product feed and start selling.

Higher-end marketplaces are also typically easier to integrate with, allowing users to take advantage of their SaaS solution to streamline processes while protecting themselves against any potential risks.

Established programs.

All of the biggest and most established online marketplaces have programs in place to help you quickly navigate the waters of marketing, selling and fulfillment.

For example, sellers on Amazon Marketplace, eBay and Google have access to Amazon Advertising, eBay Promotions Manager and Google Shopping Actions. These digital marketing programs are packed with tools to help you get your new products in front of all the right customers at just the right times.

Similar options are available to help sellers meet consumer expectations for fast, free deliveries. For instance, with programs such as Fulfillment by Amazon (FBA) and eBay Global Shipping, you can opt to have the marketplace warehouse pick, pack and ship inventory on your behalf.

Large customer bases.

As you may have guessed, many marketplace operators have enormous built-in audiences of consumers who regularly shop at these sites.

Just think: between Amazon, eBay and Walmart alone, you’re looking at close to nearly 3 billion active monthly visitors.

Did you know that many of those consumers start with marketplaces when they want to purchase products?

They don’t even bother with Google or retail websites. In fact, 49% of all product searches now begin (and often end) on Amazon.

If your products aren’t showing up in those search results, there’s a chance your competitors will land the marketplace sale before consumers ever think to visit your online store.

Business Strategies for Selling on Marketplaces

Contrary to popular belief, selling on marketplaces doesn’t have to be an all-or-nothing proposition.

Sure, there are ways to deeply embed your business within the world of marketplaces. If you’d rather take your time and test out different options, there are equally effective ways to do that, too.

Here are two different approaches to consider:

Starting a new business on marketplaces.

If your small business is looking for a fast, easy way to get products in front of shoppers, selling on ecommerce marketplaces is an excellent place to start.

While your choices may be slightly more limited compared to those of established brands and retailers, plenty of options are available to consider.

For example, marketplaces such as Walmart or Target Plus, which have strict requirements for entry, want to see a history of on-time deliveries and positive feedback before accepting you as a third-party seller.

Others will let you set up a seller account right away, including Amazon and eBay. Once you begin to build up positive reviews and ratings on those platforms, you can apply to sell on additional marketplaces as well.

Expanding your existing online store to marketplaces.

Even if you already have a thriving online store, uploading your products to select ecommerce marketplaces is an excellent way to expand your reach.

In fact, you could be missing out on sales by not incorporating marketplaces into your strategy.

Why? Because consumers have come to expect multiple options for buying the same product.

This is especially notable with Amazon, as an estimated 63% of Amazon shoppers say they always check prices on Amazon before making a purchase on another site.

And that's just on Amazon. More than 33% of consumers begin their product search on retailer sites, with 25% beginning their customer journey on alternate online marketplaces.

By expanding your online store to these platforms, you can help shoppers find the information and offers they need to buy where, when and how they want to.

Essential Steps to Leverage Online Marketplaces Success

While you could test dozens of different strategies on each marketplace, a handful have stood the test of time.

These seven steps will go a long way in getting your new marketplace account set up for long-term success.

Optimize product content.

There are product listings shoppers see and product listings people buy.

The difference?

Your product content. Product titles, descriptions and categories often compel consumers to make purchases. The more effort you put into these, the more likely you will see your listings rise to the top of marketplace search results. Services like Feedonomics can optimize your marketplace listings to help increase sales and visibility.

Take time to find the right keywords, create compelling product descriptions, identify the best categories and optimize your images.

Prepare to advertise.

The vast majority of product pages are populated with ads. However, these aren’t like the popups and banners that people tend to block or ignore. These ads get clicked.

If you want to be truly successful on marketplaces, you’ll need to invest in at least a little digital marketing to help put your products front and center.

Case in point: ChannelAdvisor sellers who advertise on Amazon grow 63% faster than those who don’t.

Calculate profits.

Each online marketplace has its own set of seller transaction fees, commissions and requirements. These fees can be complex and challenging to translate.

Taking the time to understand these differences today can ensure they’re profitable channels for you tomorrow.

Automate your pricing.

You may have solidified pricing on your online store, but that doesn’t mean those exact prices will automatically carry over to each marketplace.

Remember: shoppers often have an array of options for purchasing the same product at different prices within marketplaces.

To remain competitive in this area, you’ll need to adjust the price of each product up or down based on your competitors’ pricing. Even just a few cents can be enough to win the sale. Many sellers use algorithmic repricers to automate this process.

Diversify your shipping strategy.

In 2022, Marketplace shoppers don’t just want fast, free shipping. They expect it.

An astounding 96% of customers now expect free shipping, and 26% will abandon a shopping cart if shipping is too slow.

Without a cost-effective way to deliver on these demands, fulfillment costs could soon be eating up your profits. For this reason, having consistent access to the most competitive carrier pricing and delivery options is essential.

There are several ways to diversify your shipping strategy. Some sellers choose to leverage programs like Amazon FBA, while others rely on third-party logistics providers such as ShipBob or ShipStation.

Many use a mix of different methods to ensure the fastest, most affordable option for each order. In this scenario, you might use private carriers such as UPS and FedEx for some orders and USPS for others.

Be ready to expand.

If you’re serious about growing an ecommerce business, you’ll eventually want to start expanding to multiple online marketplaces.

When you do, the key is to streamline your growth. Many companies rely on an ecommerce platform built to integrate with dozens of different marketplaces. That way, instead of uploading your product data every time you decide to expand, you simply add your data and list products once — and then tell the platform when it’s time to share it with another marketplace.

Notify your customers.

Last but not least, don’t forget to spread the word! Send an email, push on social media or add call-to-action buttons on your website.

Whatever you choose to do, make sure your customers know they can now buy from you on their favorite marketplaces.

Expand Your Omnichannel Strategy with BigCommerce.

Omnichannel is imperative for ecommerce success. Learn how to expand your strategy with our Guide to Omnichannel Commerce.

5 Online Marketplaces to Help Scale Your Business

Based on ChannelAdvisor’s experiences with more than 2,800 sellers and processing more than $10 billion in gross merchandise volume, we know that the vast majority of sellers are able to launch quickly by starting with a handful of the most established marketplaces. Each marketplace comes with its own set of seller fees, commissions and requirements, so it’s crucial to weigh your options carefully. Here are five to consider:

Amazon.

One of the most significant benefits of selling on Amazon is access to the marketplace giant’s 200 million Prime members. These consumers spend an average of $1,400 a year on Amazon, making it a goldmine for brands and retailers.

Whether you choose to fulfill orders yourself or rely on FBA, making your products available to Prime members is critical.

Once you start selling on Amazon, you’ll have plenty of other factors to consider, but for now, your biggest decision will be which selling plan is the best fit for your business.

Amazon’s individual selling plan is enough for most third-party sellers that want to get started immediately. However, if you have products in niche categories like collectibles or fine art, you’ll need to have a professional plan and apply for permission.

The professional selling plan is $39.99 a month, plus:

Per-item selling fees, which vary by category, and

Variable closing fees and referral fees.

With an individual selling plan, you’ll pay $0.99 per sale, as well as selling fees based on each category.

eBay.

If you want to tap into the power of yet another channel with a vast global market share, eBay is a great option. This expansive marketplace gives you access to 168 million active buyers worldwide who together generate $83 billion in annual gross market value.

With 190 markets around the world, you’ll have plenty of opportunities to expand and grow.

When selling on eBay, you’ll be looking at two primary types of selling fees:

An insertion fee when you create a listing.

A final value fee when your item sells.

However, there are no setup, monthly or annual fees to worry about.

Walmart.

There are many benefits of selling online with Walmart Marketplace: You’ll have access to more than 200 million customers who visit Walmart.com each week and can also take advantage of affiliate websites, including Jet.com. Better yet, there aren’t any monthly, annual or initial setup fees. Walmart uses commission fees only.

However, Walmart has strict requirements for entry, which means you’ll have a little more lead time to launch.

If you feel your products will be an excellent complement to Walmart’s existing online portfolio of products, the first step is to fill out Walmart’s application.

Facebook Marketplace.

Facebook Marketplace is another great option when you’re just getting started — and not just because more than 2.7 billion people use the platform monthly.

With no set listing fees or commissions, Facebook Marketplace is a desirable option for new and established sellers alike.

Selling on Facebook Marketplace is an easy process, but it’s different for merchants than for individuals. You’ll need to sync your up-to-date inventory and then wait a week or so for Facebook to review your products and deem them suitable to sell on Marketplace.

Wish.

Wish is a cross-border ecommerce marketplace.

As one of the most downloaded global shopping apps with over 60 active countries, Wish boasts 90.1 million visits per month. Wish’s navigational shopping experience and cross-border logistics also provide merchants numerous opportunities to broaden their exposure to users worldwide.

Before January 2022, Wish was open to merchants who wanted to sell on their platform. In order to gain more trust from users and improve its public image, Wish is overhauling its platform and is now invite-only.

Wish has also implemented a new program called Wish Standards that rewards merchants for providing positive customer experiences.

Expanding to Global Marketplace Audiences

Did you know that 7 out of 10 online shoppers make purchases from international sites?

Once you get comfortable selling domestically on online marketplaces, the next step is to expand your online business to international audiences.

More than 80% of retailers worldwide say cross-border ecommerce has been profitable, so this is one opportunity you don’t want to miss.

Asia-Pacific.

The Asia-Pacific region, often referred to as APAC, is currently experiencing a renaissance when it comes to online shopping.

With the largest population in the world, it is no surprise to see its continuing success, due in no small part to the following marketplaces:

Alibaba

A leading online marketplace in China, Alibaba is a name online providers should be familiar with. Over the last half-decade, Alibaba’s active consumers has nearly doubled, reaching 882 million by the end of 2021.

AliExpress.

AliExpress, a subsidiary of Alibaba, is an online retail service based in China. Its service range extends outside of China, however, as it is the one of the most visited ecommerce platforms in Russia.

Amazon China.

Amazon China is an online platform headquartered in China. Formerly known as Joyo.com, Amazon purchased the company and renamed it in 2004.

However, unlike other marketplaces in the region, Amazon China has, as of 2019, focused on cross-border selling to Chinese customers as opposed to domestic sales.

Rakuten.

Rakuten is a Japanese ecommerce and online retailing company that boasts more than 544 million monthly domestic visitors.

Though it is sometimes referred to as the Amazon of Japan, Rakuten has offices worldwide.

Taobao.

Taobao is a Chinese online marketplace. Like AliExpress, it is a subsidiary of Alibaba.

Taobao separates itself from the other Alibaba subsidiaries in that it focuses primarily on C2C sales channels as opposed to B2B. It launched as a competitor to eBay China, before eventually overtaking it and forcing eBay to exit the market. .

TMall.

TMall, formerly Taobao Mall, is yet another subsidiary of Alibaba. Unlike Taobao, which it spun off from in 2011, TMall focuses primarily on direct-to-consumer (D2C) business.

With a significant user share of 58%, TMall is one of the top three online shops in China.

Europe.

Europe and the European Union compose the third largest market in the world.

Though recent privacy laws like GDPR have complicated marketing efforts, online marketplaces have flourished and are expected to continue to grow.

Amazon Germany.

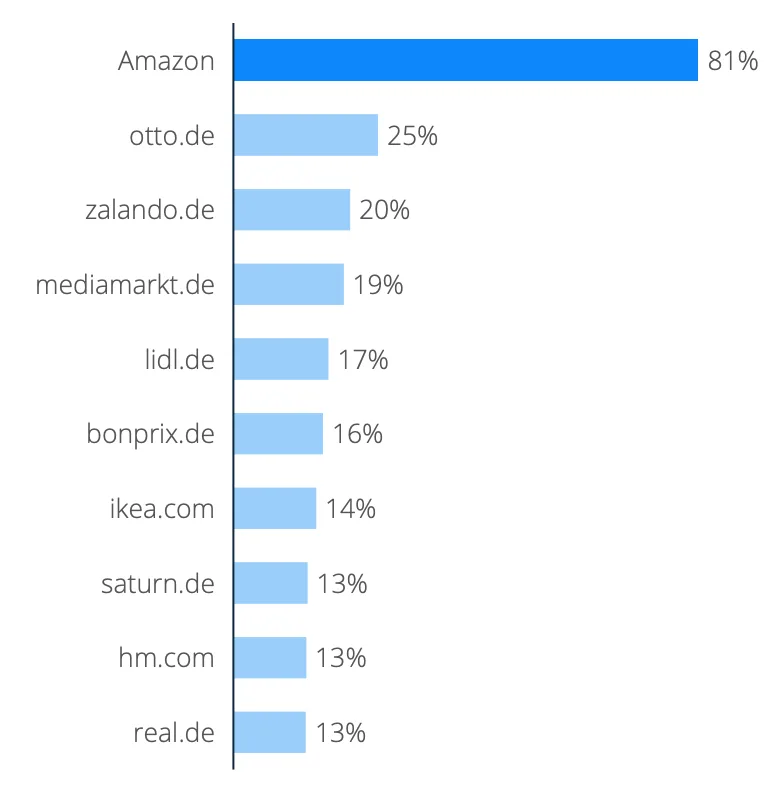

Amazon is the dominant marketplace in Germany, with an impressive 81% market share.

La Redoute.

La Redoute is a French, multichannel retailer. Founded in 1837, it is one of the largest fashion and apparel ecommerce sites in France, with more than 7 million monthly visitors.

Otto.

The Otto Group is one of the largest online shops in Germany, ranking second behind only Amazon in revenue.

Over the last year, Otto Group reported around 10 billion euros of online revenue worldwide, an increase of almost 25%.

Zalando.

Zalando is a German-based ecommerce organization that ranks as the leading fashion ecommerce marketplace in Germany, with more than $2 billion dollars in sales generated in 2020.

Latin America.

The Latin American region is another quickly growing ecommerce marketplace. With an incredible 36.7% sales growth from 2019 to 2020, the region swiftly outpaced expectations, primarily due to the following organizations:

Mercado Libre.

Dubbed the “Amazon of Latin America,” Mercado Libre has grown exponentially as the region's leading online marketplace operating in 18 countries and reaching 65 million shoppers daily. Mercado Libre saw its net revenue increase by 73% and reach almost 4 billion US dollars in 2020 — more than its revenue in 2018 and 2019 combined. The company’s total number of unique active users in 2020 had a similar surge, amounting to 132.5 million.

Amazon Mexico.

Amazon Mexico was launched in 2013. It took no time for it to quickly blossom, becoming the second largest ecommerce platform in Mexico with a 57% user share.

The Final Word

Whether you’re getting ready to launch a new ecommerce business or have been selling online for years, online marketplaces should be a central part of your strategy.

Thankfully, it can be relatively painless to get started with this business model. You can launch quickly, reach built-in audiences immediately and take advantage of established programs that make it easy to market, sell and fulfill within each platform.

By following the steps in this guide, you can be selling on these popular platforms in no time.

First, decide which marketplaces will be the best fit for your brand. This will vary from business to business and depend on factors such as marketplace fees, requirements and top categories.

From there, you can move on to bigger and bolder strategies that will help get your products in front of millions of purchase-ready consumers — perhaps even more than you dreamed possible.

Although it may all seem daunting at the outset, trust us: Once you start to experience the profit potential and streamlined functionality of selling on online marketplaces, you’ll never look back.