Grow from $1 Million to $100 Million

Explore our collection of resources filled with actionable strategies, expert insights and everything you need to increase ecommerce sales.

Consumer Behavior Trends: Alternative Payment Methods

Consumer Behavior Trends: Alternative Payment Methods

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

Many online retailers are already on a mission to create the ultimate customer experience — from optimizing their website to personalizing product recommendations to selling across social media.

But there’s one thing that many businesses forget: The customer experience doesn’t stop at checkout.

According to data from the Baymard Institute, approximately 17% of shoppers abandon their cart when the checkout process is too long or complicated, and 9% abandon their cart when an online store doesn’t offer enough payment methods — which goes to show that a poor checkout experience can make or break a sale.

For decades, cash, check and card transactions have dominated consumer and business payments. But over just the last few years, the industry has seen trends of contactless, installments and channel-less payment methods taking hold.

From the rise of digital wallets such as PayPal and Apple Pay to cryptocurrency payments like Bitcoin, it’s evident that shoppers are seeking a truly frictionless ecommerce buying experience.

In fact, according to Statista, the total transaction value in the digital payments segment is projected to reach $8.49 trillion in 2022, which suggests these trends aren’t slowing down any time soon.

How Buy Now, Pay Later is Transforming Online Shopping

A standout among the alternative payment methods today is Buy Now, Pay Later (BNPL), a point-of-sale financing solution that allows customers to pay in installments rather than paying the entire cost up-front.

In fact, BNPL users are projected to grow in the coming years to account for 44% of digital buyers by 2025.

But what makes BNPL so attractive to today’s consumers?

According to a survey by eMarketer, these are the top four reasons consumers are using BNPL:

To avoid paying credit card interest (39.4%).

To make purchases that otherwise wouldn’t fit into their budget (38%).

To borrow money without a credit card (25%).

Unable to get approved for a credit card (14%).

Their credit cards are maxed out (14%).

They don’t have bank accounts (3%).

Although BNPL has been in the works for years, COVID-19 undoubtedly increased the demand for alternative payment methods. Amid pandemic-driven layoffs and financial uncertainty, interest-free BNPL solutions became an attractive alternative for consumers in need of greater payment flexibility.

“It’s also really easy to use,” said Paul Paradis, President of alternative payment platform at Sezzle, in a recent Make It Big Podcast episode. “If you’ve ever applied for a store credit card, it’s a painful process — you have to fill out a long form, the issuing bank will run a credit check that takes a long time, your credit score will get dinged, etc.

“Then you might be approved, whereas BNPL is a super short form online. There’s typically no credit check involved whatsoever, and you get an approval decision in a couple of seconds with a much higher likelihood of getting a yes.”

Exploring BNPL in BigCommerce’s Global Consumer Report

With all of these benefits in mind, it’s no wonder the BNPL market is skyrocketing — and undoubtedly impacting the world of ecommerce.

In our Global Consumer Report, BigCommerce surveyed more than 4,000 online shoppers in the US, UK, Italy, France and Australia to help uncover the major trends that are shaping retail today and in the future. And, of course, alternative payment methods were top-of-mind.

In fact, search trends from Google show that searches for “buy now, pay later” have grown globally by over 50% year-over-year (YoY), while searches for “buy now, pay later apps” have grown globally by over 200% YoY.

On top of that, when we asked consumers which payment methods they have used when shopping online, 16% said they have used BNPL.

Pros and Cons of Choosing BNPL

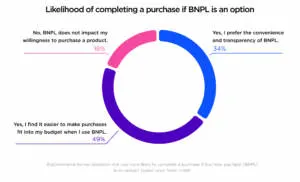

Furthermore, BigCommerce wanted to uncover why consumers are choosing — or not choosing — BNPL, and whether consumers are more likely to complete a purchase from retailers that offer BNPL as a payment method.

Sure enough, for consumers who have used BNPL, it does have an effect. When asked why they’re more likely to complete a purchase if BNPL is an option, 49% of respondents said it allows them to make purchases fit into their budget, and 34% said they prefer the convenience and transparency of BNPL.

On the flip side, there are some potential blockers that may deter some consumers from using BNPL. Of the respondents who said they had not used BNPL, 48% said they prefer to pay outright for all purchases or use a credit card (Baby Boomers especially), 21% said they don’t understand how BNPL works and 20% said they’re concerned about late fees or missed payments negatively impacting their credit score.

Despite these blockers, education on BNPL, specifically around how late fees work, can help instill confidence in consumers and demonstrate that BNPL is a viable payment option.

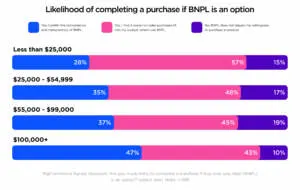

Consumers with higher incomes prefer the convenience of BNPL.

The fourth most common reason (16%) for not using BNPL was that consumers were afraid they wouldn’t be financially able to make one or more of my payments after the initial payment.

Unsurprisingly, the majority of those who chose this reason made less between $25,000 and $54,999 per year (39%) or less than $25,000 per year (34%).

Alternatively, our report found that as income increases, so does consumer preference for BNPL. This can likely be attributed to the fact that those who make more money have more disposable income, and are therefore less worried they will be unable to make a payment.

Merchant Spotlight: Winstanleys Pramworld

When Winstanleys Pramworld decided to move away from Magento, the stroller and nursery retailer wanted a SaaS solution that would manage all updates and patches and give them the biggest bang for their buck.

Switching to BigCommerce, Pramworld found that BigCommerce not only offers a speedy checkout, but also multiple payment options, such as BNPL solution Klarna.

“It was so easy to implement Klarna,” said David Winstanley, Director of Winstanleys Pramworld. “It took us less than a week from when we decided to integrate Klarna until it was actually up and running on our site, and we’ve noticed it is helping increase our conversion rate.”

But Pramworld isn’t the only BigCommerce merchant reaping the benefits of alternative payment methods. With over 70 payment integrations and apps, including gateways, BNPL solutions such as Klarna, After Pay, Sezzle and Affirm, and digital wallets including Apple Pay, Google Pay and Amazon Pay, BigCommerce merchants can let shoppers pay how they want.

The Final Word

“Digital payments once revolutionized commerce. Now, commerce will revolutionize payments, making them an invisible, invaluable part of an elegant, customer-first commerce experience,” Forrester says.

From pre-purchase to post-purchase, every touchpoint in the shopper journey has the potential to make or break a sale — and online payments are no exception. Customers want the flexibility to shop on their own terms, and the best way to give them that is by providing a quick and easy checkout experience with a wide selection of payment options.

For businesses who want to remain on the cutting edge and meet the needs of today’s consumers, implementing Buy Now, Pay Later into your storefront can only serve to benefit you.

For more insights into alternative payment methods and other consumer shopping trends, check out BigCommerce’s Global Consumer Report.

Haylee is a Content Marketing Writer at BigCommerce, where she partners with the SEO team to craft narratives and blog content. She earned a B.A. in English Literature from the University of Texas at Austin and afterward spent a year abroad to pursue a Master's in International Management from Trinity College Dublin. When she’s not writing, you can usually find Haylee with her nose in a book, enjoying live music or scoping out the best local coffee shops.