The 8 Must-Follow Business Principles That Drove 832% Growth and $5M in Revenue

A few years after high school, I read “The 4-Hour Workweek,” quit my job and moved to Buenos Aires. I was convinced I could run a business while traveling, making U.S. dollars and spending Argentinian pesos, while chatting over Skype with a supplier in China, coffee in my hand and tea in theirs.

I wanted this to work. I selected a few products and hired expensive web developers to build me a site. All that ever came of it was a few ugly pages and an endless amount of 404s before I ran out of money.

My plans for an endless vacation failed miserably, and quickly, as did 6 other ideas I had had prior. I decided to go back to college and abandon my dream.

My plans for an endless vacation failed miserably, and quickly, as did 6 other ideas I had had prior. I decided to go back to college and abandon my dream.

You’d think maybe I wasn’t a good businessman, but youth was on my side. And, as it turns out, so was technology.

I started my current business, Flexfire LEDs, in 2010. I was a junior in college at the time and refused to give up on what I knew was possible. I could see that LEDs were the future of the way we light our planet, and I wanted to be a part of it.

Prior to 2010, starting an online business was near impossible. Trust me. I tried.

It took knowing how to code to build the site.

It took having the right connections to get yourself a single product.

It took earning trust –– not to mention traffic –– just to get a sale.

Some of those things are still very true.

You still need to earn trust and drive traffic. But you don’t have to know how to code anymore to build yourself a site. Nor do you necessarily need connections in the industry to get yourself some great products.

Widespread internet usage solves for the latter –– where you can Google suppliers and build relationships.

And technology like BigCommerce solves for the former –– where you can build a site and customize it without touching a single piece of code.

The only problem left to solve is the need to drive traffic and trust. And on this, I have become an expert.

The Business of B2B

Our customer base is split 50/50 for homeowners (regular consumers) and businesses (B2B). And yet, only 20% of our revenue comes from our B2C segment.

Today, Flexfire LEDs drives more than $5M in annual sales. Our customer base is split 50/50 for homeowners (regular consumers) and businesses (B2B). And yet, only 20% of our revenue comes from our B2C segment.

That’s because businesses buying from other businesses buy in bulk –– and they buy often. Their large, regular orders drive the majority of our business. And, we partner with the best in the industry:

Kohler

Boeing

Disney

Marriott

Google

Apple

Bellagio

Embassy Suites

Ford Motors

The list goes on.

Now, of course, earning customers like that and hitting a multi-million dollar revenue mark didn’t happen overnight.

But it did happen between 2013 and 2015 –– when our business was growing 832%.

BigCommerce's B2B Power

Flexfire LEDs isn’t the only B2B company using BigCommerce to skyrocket growth. Read more about how Atlanta Light Bulbs uses the platform to scale their B2B business faster than ever before.

How to Earn a 832% Increase in Revenue

Little did we know, we were following Google’s “best marketing practices for 2017” book back in 2010. Each Google update in the subsequent years shot our rankings up and our competition down.

In 2013, Google released Hummingbird, the single largest change to Google’s search algorithm in 12 years.

This wasn’t an update like Panda or Penguin. This was a completely new algorithm –– this time, focused on conversational and semantic search. The goal was to deliver more accurate search results –– as any Google algorithm update always is.

But in 2013, it was incredibly needed because the results Google kept showing weren’t any good at all.

And that’s because back in 2010 and 2011, SEO techniques were pretty much centered around this thought:

Trick Google into ranking you higher.

Everyone was doing it. That was back when there were link farms and content companies that would write junk keyword-stuffed articles in less than 500 words. The content wasn’t good, needless to say.

We went a different route.

I like to think of Google as an all-powerful librarian.

What would the librarian want to see to recommend the best book to the person asking for it?

That is always how I’ve approached content and Google –– and in 2013, it paid off.

Big time.

That’s because we started creating content in 2010 that answered the questions we had ourselves when first researching LED strip lights and how to install them.

We didn’t focus on:

Spamming forums with linkbacks

Creating 500 word keyword stuffed blogs on non-relevant websites

We focused on:

Education

Customer experience

Adding value

Little did we know, we were following Google’s “best marketing practices for 2017” book back in 2010. Each Google update in the subsequent years shot our rankings up and our competition down.

Organic traffic has always been our biggest source of traffic. Our first sale came from one of our articles explaining the technical difference between two types of LEDs.

And it is our educational content that builds brand trust and traffic –– even among the industry’s most trusted brands themselves.

The 8 Business Principles to Long Term Success

I know all too well thanks to my years of entrepreneurial setbacks that to focus on immediate profit meant near immediate failure.

To stick it out back then, and to follow our gut on what we knew was good content –– but content that didn’t immediately get the traffic it deserved –– was hard.

It took dedication and conviction to business principles others were forgoing in the name of immediate profit.

I knew all too well thanks to my years of entrepreneurial setbacks that to focus on immediate profit meant near immediate failure.

The principle I stuck with back then was the same as Amazon’s is now:

To be customer-centric, to educate and to add value, to be a source of trusted information, and quality products for when they are ready to actually buy.

Some folks out there call this the value ladder approach. Others say it is how Amazon hockey-sticked to unparalleled ecommerce dominance.

For me, it’s about following these 8 principles on a daily basis so my own business will be successful for the long haul.

These will lead you to success, they have for me.

Of course, it won’t always be easy. You can rest assured, though, that the markets favor those who treat the customer well. These principles will keep you aligned with what is best for them, which is ultimately, if not immediately, what is always best for your bottom line.

1. Always take it one step further

Whenever you think you have gone as far as you can, ask yourself if you can take one step further.

I call this the OSF (one step further) mentality and it dictates that you always take that additional step for your employees, your customers, and with your products.

Whenever you think you have gone as far as you can, ask yourself if you can take one step further.

Do things your competitors aren’t doing, or do them just a little better. Word travels fast –– especially online.

Do things that your clients don’t expect. Today, we sent out boxes of girl scout cookies in the orders that went out.

Why? Who does that?

We do! Why not!?

Create a special experience for your customers in your own way. You are in the business of building a relationship with your customers and your brand. Reviews are VERY IMPORTANT for an online company. Even a few bad ones can be damaging. Take that extra step to make everyone happy, even the problem customers. It will come back around.

2. Focus on content –– really good content.

Write down everything that frustrates you about your industry, competitors, product, and keep adding to that list on a daily basis.

By focusing on education and a “one-step-further” approach to our customer service, Flexfire LEDs was able solve the biggest hurdles in the buying process for our customers and started generating sales the first month of business.

My advice to you to do the same is: write down everything that frustrates you about your industry, competitors, product, and keep adding to that list on a daily basis.

Each one of these notes is a potential game changer in your industry.

Many trees add up to a forest. Again, OSF!

If you get the same question more than 5 times from customers writing in, consider writing a nice article educating your customers about it. Better yet, make a video.

Focus on education and creating a wonderful experience with your customer service. Be the company that you wish was always there for you when something went wrong. Pleasantly surprise your clients.

3. Automate, read, repeat.

Books are like a cheat-sheet to the open note test that is life and business.

Use technology and educate yourself!

There are hundreds of apps, outsourcing services, and ways to automate processes that are here now that weren’t a few years ago. Take some time and think the processes through, then automate.

For example, we use:

Trello for project management

Slack for communication internally

All Google apps (gmail, google drive, sheets, docs, etc)

Shipstation and Fishbowl for shipping and inventory

OptinMonster for marketing

Mailchimp and Active Campaign for email marketing

Taxjar, Avatax, Quickbooks for financial

Stamped.io for reviews

Zapier for easy integration and APIs

Powr.io for form creation

ContactMonkey for internal emails

BigCommerce for our ecommerce hosting

I also employ a variety of graphic designers, developers, and admin types through Upwork, and have built out a virtual team to be able to take on additional tasks. Plus, thanks to the virtual, global team, we now have a global market to search from for employment.

That will give you more time to read.

You can start with the “4 Hour Work Week” and “The Art of Less Doing,” both of which educate you on how to do more, better, and in less time. The answers to many questions you have or will eventually have are already written and available. Read often.

Books are like a cheat-sheet to the open note test that is life and business.

Here’s a list of books that have helped me with always maintaining a leadership mindset and have given me instantly effective lessons on how to better run a business.

“Double Double: How to Double Your Revenue and Profit in 3 Years or Less” – Cameron Herold

“Creativity, Inc.” – Amy Wallace and Edwin Catmull

“Traction” – Gino Wickman

“Delivering Happiness” – Tony Hsieh

“Start with Why” – Simon Sinek

4. Ask for help and advice.

Whatever hurdle you encounter, someone else has probably solved it before you.

I bootstrapped the whole company for the first two years. During that time, I outsourced a lot of work and came across a million challenges. The short story is this:

I made mistakes.

Just about every day I came across a new challenge. My biggest lesson was this:

Whatever hurdle you encounter, someone else has probably solved it before you.

Whenever I was stuck, I would reach out to anyone I think could have the answer. Don’t be afraid to reach out to thought leaders, other CEOs, university professors, or even authors and celebrities if you think they can help.

Successful people love to help other people succeed.

Whenever I would get nervous about asking for help, I would think, “It feels great to offer advice and help others, right? Yeah! Why would I take that opportunity to feel great away from someone else?

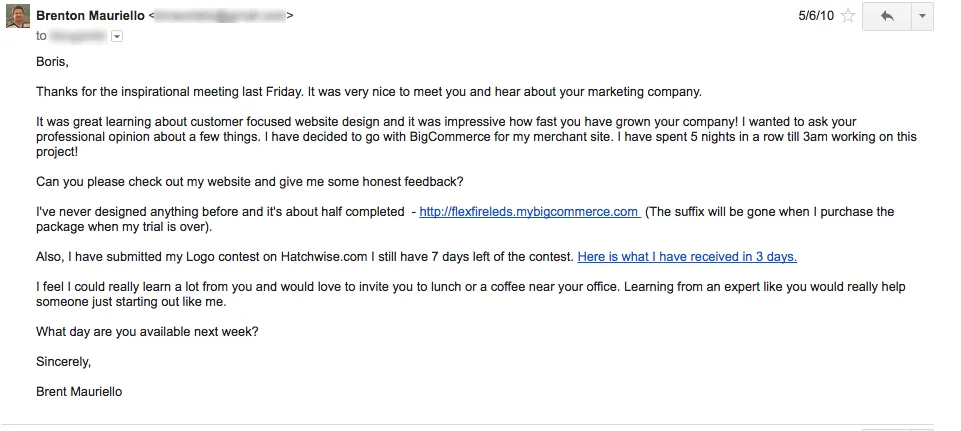

Here’s an actual example of how I started my relationship with one of the most influential mentors I have ever had:

5. Start with your vision then work backwards.

Use your imagination to paint a picture of what you want your business to look like in 3 years.

You cannot choose which path to take if you don’t know where you want to go.

In the book, “Double Double” by Cameron Herold, the first few chapters are an outline of the most powerful exercise that changed the course of our company.

I attribute a lot of our success to it and recommend it to all entrepreneurs.

It’s called the Vivid Vision exercise and in short, it calls on you to use your imagination to paint a picture of what you want your business to look like in 3 years.

Imagine a painting that is composed of every aspect of your life and business 3 years from now. Notice as many details as possible. You’re making money and having fun.

What do you see?

Who are your clients?

How many employees do you have?

Which magazines are talking about your products?

Which awards have you won in your industry?

What do your employees say about your company?

Are you commuting or teleconferencing?

What does the desk in your office look like?

Each detail outlined in your picture is a goal. Take that goal and work backward and you will create an actionable plan on how to obtain that goal.

In my vision, for example, I saw our product installed in airports around the world. I saw that if I created content about airport lighting it would attract the eyes of designers working on airport projects.

Today, our products are illuminating many major airports around the world!

Don’t wimp out. Think big!

6. Be insatiably curious.

I have no special talent. I am only passionately curious.

Curiosity drives research and innovation. Some of Flexfire LEDs’ most successful products came from the curious exploration of unrelated topics.

For example, an article about a melatonin supplement lead me down a rabbit hole of learning about how light affects circadian rhythms and sleep patterns. Blue light can suppress melatonin production in humans. Based on this research we decided to manufacture a strip light with alternating LED chips that allow the user to select a warm, candle-like color white for bedtime, and a cool, daylight colored light for during the active parts of the day. This way your lighting does not disrupt your sleeping patterns.

The moral of the story is this:

Starting your own business requires you to learn a lot about a little and a little about a lot.

Curiosity and the desire to learn are among the most important qualities I look for in employees because curious people do not back down from mental challenges and don’t give up in the middle of a research task. They’re also more fun to be around in my opinion.

You are going to be learning a lot about your business. Enjoy the exploration and expand your knowledge base.

7. Know the importance of your team.

Business is not a zero sum game.

I love my team. I really do! Even as we grow to more than 25 employees, I can say that everyone on the team is there for a reason, is in the right place, and doing the right things.

Creating and maintaining an internal culture of free expression, trust, openness, creativity, mentorship, and a burning desire to help our clients may sound too millennial to some, but for us it is our secret sauce.

Notice I am not talking about the importance of hiring the right people, a strict interview process, and building the right team (which is VERY important). I am already assuming you know that.

When I say the importance of your team, I mean that they are very important to you and you care about them.

As a business owner I realize that people are spending valuable time on this planet building my dream. I believe in making it their dream, too.

If your best employee’s life goal is to work in another industry, spend time with him/her and help them to pursue that, even if that means them leaving your company.

Yes, you heard me right.

Help them achieve their dreams, just as they are helping you achieve yours. While they are employed by you, they will give it their all, and when they go on to achieve their goals, they would have left your company better for have been there.

Business is not a zero sum game.

Focus on treating your employees right and it will come back to you 10X.

Invest in their health, education, and happiness and you will have loyal and a more creative and harder working staff than all your competitors.

Most employers believe that happiness is pay related. I believe it is a symptom of doing what you love and being appreciated.

8. Sell a product you are proud of

No one wants to be ripped off –– don’t be that company.

Most important, having a quality product is the only way to succeed in business. OK, not the only way, but the only way that will help you win quicker and allow you to sleep at night.

For me, my story on this starts here:

The LED lighting market in 2010 was still getting off the ground, but was finally becoming advanced enough to directly replace other lighting systems at a fraction of the energy usage and at a cost low enough to penetrate the market and disrupt legacy lighting technologies.

Back then, there were many LED products and markets to choose from with low barriers to entry. The big players had not yet made their move into the market.

I considered many types of LED products, but came to the realization that, from my garage and with $500, there was no way I could compete in the commercial lighting space once the big players got involved with high investment capabilities, extensive distribution channels, and large sales staff.

I kept coming across a unique product called an LED strip light. It was a niche product, which meant I could build a company well before the big guys became interested in competing.

The LED tape light could be cut every inch or so and installed practically anywhere to provide bright, crisp, and beautiful direct or indirect linear lighting almost anywhere imaginable.

We could only imagine the endless uses and applications from such a cool product!

However, I noticed that almost all of the products being produced within our niche were poor quality, were inaccurately representing specifications and output data, and offered almost no education about the product.

Frustrated, I decided to make the highest quality LED strip light in the world, and focus our company on the best product and education with the customer service I wish I had received all my life.

I didn’t care if people used our articles and then purchased somewhere else. I just wanted them to have the correct answers about the product. They eventually come back to us when the other company’s products failed.

Final Word

It’s faster to change the industry than wait for the industry to change on its own.

We didn’t start our company with any seed money from investors. It was just a kitchen table, a garage, a vision, and a curious mind.

Though we were making sales, things started very slow. I remember when we made $200 in sales in a day, we’d high five, pack it up and go to the beach or go for a hike. We were bootstrapping, so we didn’t need much to keep it going.

Back then, the lighting industry was (and partly still is) an antiquated offline distribution model that didn’t trust online stores. I mean, we are trying to sell light over the internet, so I understand.

We relied heavily on (and still do!) our online reviews and customer submitted photos to build trust in our company and products. Word of our product and service traveled fast and we started picking up sales through referrals.

It’s faster to change the industry than wait for the industry to change on its own.

And following these principles is what has lead me, my business and my team to industry leader status. We didn’t wait. We acted, we educated, we were honest and we were patient.

Today, I’m finally able to achieve my 4-hour work week dream. In fact, just this morning, I was on the phone with an employee in China, as they drank tea and I drank coffee.

In that way, my vision is complete.

Brent Mauriello is a serial entrepreneur and the founder and CEO of Flexfire LEDs, the industry leader in high intensity architectural and commercial grade LED strip lighting. When he isn’t focused on his business or reading books to boost growth, he loves inspiring others and connecting the dots to wonderful relationships. His entrepreneurial journey has led him to specialize in LED lighting, light design, marketing (both online and offline), new business development, venture funding, international logistics, negotiation, branding, personal motivation and conflict resolution, SEM, SEO, the BigCommerce platform and Google analytics.